Customer Lifetime Value (CLV) is one of the most critical metrics for any e-commerce business. It tells you exactly how much revenue a customer generates throughout their entire relationship with your store. Understanding CLV helps you make smarter decisions about how much to spend on customer acquisition and where to focus your retention efforts.

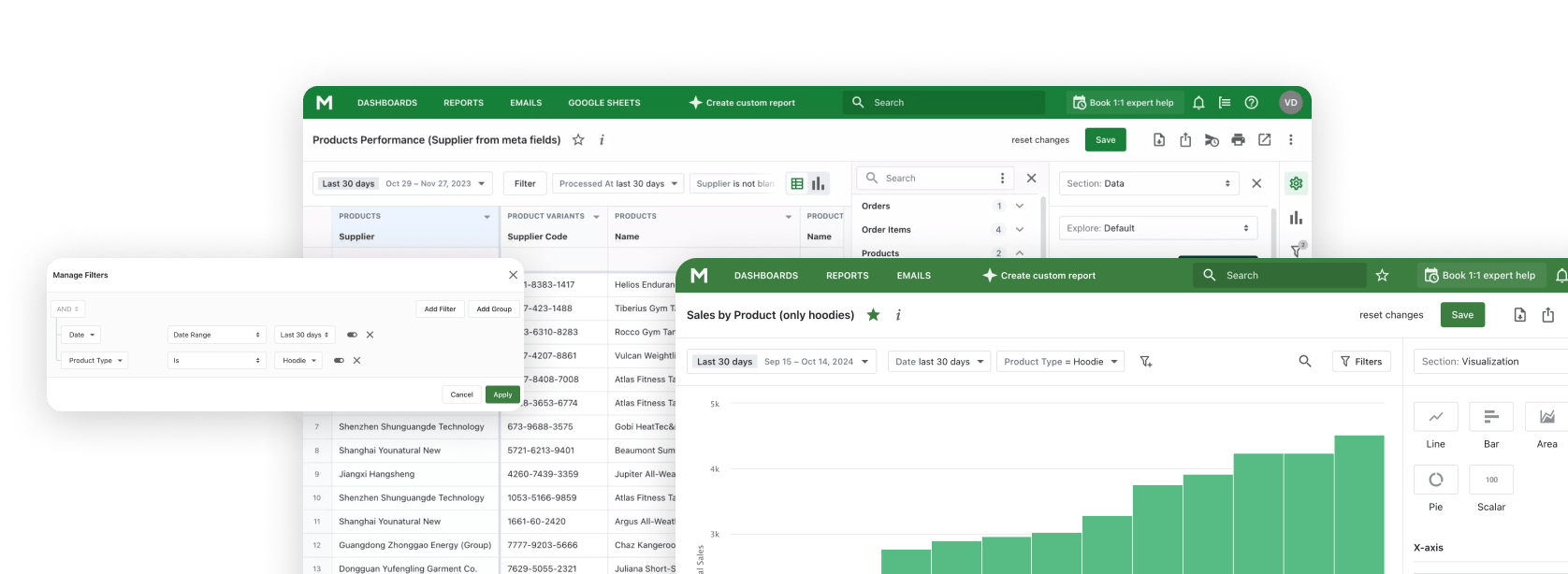

With Mipler's Shopify Reports, you can track CLV for every customer in your store. The Customer Lifetime Value Report shows each customer's total spending, order count, and helps you identify your most valuable shoppers at a glance.

Why Customer Lifetime Value Matters

Many store owners focus only on individual transactions, missing the bigger picture of long-term customer value. A customer who makes small frequent purchases may be worth more than someone who made one large order and never returned.

The CLV metric answers critical business questions: How much can you afford to spend acquiring a new customer? Which customers deserve VIP treatment? Where should you focus your retention efforts? Without this data, you're essentially flying blind with your marketing budget.

Stores that track and act on CLV data typically see 25-95% higher profits. This is because they know exactly which customer segments to invest in and can calculate acceptable customer acquisition costs (CAC) with precision.

Benefits of Tracking Customer Lifetime Value

Optimize Acquisition Spending by knowing exactly how much you can afford to pay for a new customer

Identify VIP Customers and create special programs to keep your highest-value shoppers engaged

Improve Revenue Forecasting by predicting future income based on customer value trends

What the Customer Lifetime Value Report shows:

Customer Name

Full name of the customer for easy identification and outreach

Customer Email

Email address for direct communication and marketing campaigns

Total Spent

The complete sum of all purchases made by this customer - their lifetime value

Order Count

Total number of orders placed, indicating purchase frequency and loyalty

How to Use CLV Data for Your Store

Once you have CLV data, you can apply it in several powerful ways:

- Set CAC Targets: If your average CLV is $500, you know you can profitably spend up to $100-150 on customer acquisition (following the common 3:1 CLV:CAC ratio).

- Create VIP Tiers: Segment customers into tiers based on CLV and offer exclusive benefits to your top spenders - early access, special discounts, or dedicated support.

- Focus Retention Efforts: Identify high-CLV customers who haven't purchased recently and prioritize them for win-back campaigns.

- Evaluate Marketing Channels: Compare the CLV of customers acquired through different channels to find your most valuable traffic sources.

Build and Automate Your CLV Reports

Mipler offers several ways to make CLV tracking effortless:

- Scheduled Reports: Set up automatic daily, weekly, or monthly CLV reports delivered to your inbox, Slack, or Google Sheets.

- Custom Columns: Add calculated fields like CLV-to-CAC ratio or predicted future value based on purchase patterns.

- Alerts: Get notified when high-value customers haven't purchased in a while, so you can act before they churn.

Important

Customer Lifetime Value is most powerful when combined with other customer metrics. Use the CLV Report alongside RFM Analysis to understand not just how much customers spend, but how recently and frequently they purchase. This combination gives you a complete picture of customer health and helps you identify at-risk high-value customers before they churn.

FAQ

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value is the total revenue a customer generates for your store over their entire relationship with your business. It includes all purchases from their first order to their most recent, giving you a complete picture of each customer's worth.

How is CLV calculated in Mipler?

Mipler calculates CLV as the sum of all order totals for each customer. You can view this for any time period (last 30 days, last year) or for the customer's entire history with your store. The report also shows order count so you can see purchase frequency alongside total value.

What is a good CLV:CAC ratio?

The general benchmark is:

- 3:1 or higher: Healthy ratio - you're generating good returns on acquisition spend

- 1:1 to 3:1: Break-even to modest returns - room for optimization

- Below 1:1: Unsustainable - you're spending more to acquire customers than they're worth

However, ideal ratios vary by industry and business model. Subscription businesses often target higher ratios.

How can I increase Customer Lifetime Value?

Several strategies can boost CLV:

- Improve retention: Email marketing, loyalty programs, and excellent customer service keep customers coming back

- Increase order frequency: Subscription options, replenishment reminders, and personalized recommendations

- Raise average order value: Upsells, cross-sells, bundles, and free shipping thresholds

- Extend customer lifespan: Win-back campaigns for churning customers

What reports should I combine with CLV data?

For comprehensive customer insights, combine CLV with:

- RFM Analysis: Segment customers by recency, frequency, and monetary value

- Sales by Customer: Detailed transaction breakdown per customer

- Inactive Customers: Find high-CLV customers at risk of churning