A guide with practical and action orientation in store ownership. The plan fees, platform transaction fee, credit card processing, real-life case, a checklist to save money, and straightforward upgrade instructions. Shopify does not charge you a cut of your revenues, but rather, per-transactions fees, which depend on the plan and payment gateway.

Shopify Fees and Commission Explained

Shopify costs typically include three layers:

- Monthly subscription: plan price (from around $19 to enterprise tiers).

- Shopify platform transaction fee: 0% - 2% if you use a third-party gateway (waived with Shopify Payments).

- Card processing fee charged by payment providers (commonly around 2.4 - 2.9% + $0.30 per transaction in the U.S.).

Using Shopify Payments removes Shopify's platform transaction fee, but you still pay card processing rates.

What Percentage of Sales Does Shopify Take?

|

Plan |

Monthly Cost (typ.) |

Shopify Platform Fee (non-Shopify gateway) |

Typical Card Fee (US, example) |

|

Basic |

$19 |

2% (0% with Shopify Payments) |

2.9% + $0.30 |

|

Shopify(grow) |

$52 |

1% (0% with Shopify Payments) |

2.6% + $0.30 |

|

Advanced |

$399 |

0.6% (0% with Shopify Payments) |

2.4% + $0.30 |

|

Plus |

Custom (starts around $2,300) |

Custom negotiated rates |

Often 2.1 – 2.4% (negotiated) |

Percentages vary by country and by merchant agreement. Use the table as a planning reference, not a legal rate sheet.

Real-World Case: When Upgrading Saves Money

Scenario: A store with $10,000 in monthly gross sales.

- Basic (2.9% card fee): ≈ $290 in card fees.

- Shopify (grow)(2.6% card fee): ≈ $260 in card fees.

- Advanced (2.4% card fee): ≈ $240 in card fees.

The percentage difference of per-transaction gives low savings of 10k monthly. It should be noted that at this point, a higher monthly subscription can easily be compensated by the lower percentage on a higher plan, provided that your monthly volume increases to above about 15k-20k.

Explore related reports

Extra Costs Beyond Shopify Fees

- Payment gateway fees: Stripe, PayPal, and other processors charge their own rates (around 2.9% + $0.30 per US card payment).

- Currency conversion fees: Additional percentages apply when selling in other currencies.

- App subscriptions: Monthly or usage-based app costs that add to Shopify selling fees.

Action Checklist: How to Reduce Shopify Costs

- Enable Shopify Payments (if available in your country) — removes the platform transaction fee.

- Compare plan ROI: Calculate break-even turnover for upgrading plans.

- Audit apps quarterly: Remove unused paid apps and consolidate functionality.

- Optimize currency strategy: Offer localized checkout or multi-currency to reduce conversion fees.

- Negotiate with processors: For high volume, request custom card processing rates.

- Use advanced reporting: Track your net margin after all fees (platform + processor + apps).

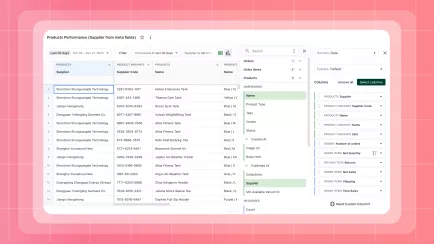

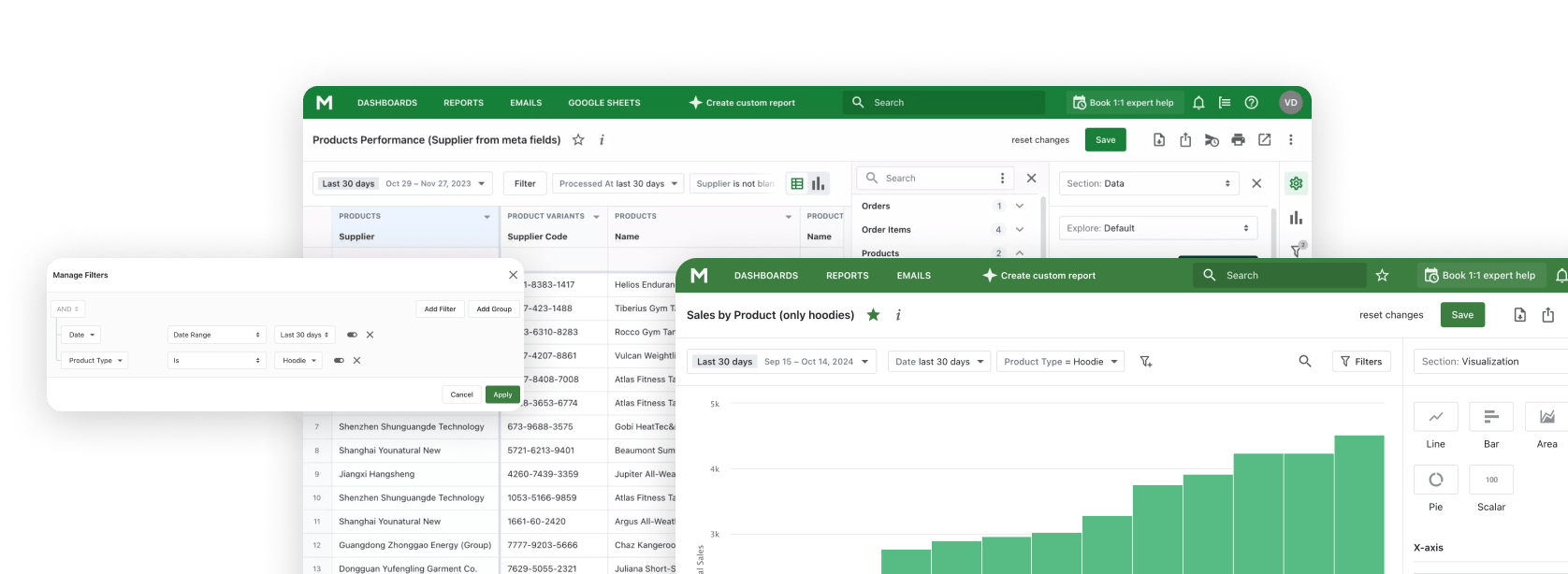

Advanced View of Shopify Fees with Mipler

Mipler Shopify Reports is aimed at enterprise merchants with complex needs and high volume. Typical triggers include:

- Monthly gross volume around $100,000+.

- Need for custom checkout, multiple storefronts, or wholesale channels.

- Requirement for negotiated card and platform rates to improve margins.

If you meet those triggers, Mipler often delivers lower per-transaction costs and enterprise-grade support that can justify the higher monthly fee.

Tools & Metrics to Track with Mipler

To manage fees and margins, track these KPIs weekly or monthly using Shopify Custom Reports :

- Gross sales vs. net sales after fees.

- Average order value (AOV) – higher AOV reduces relative fixed fee impact.

- App spend per month.

- Chargebacks & refund frequency.

Reporting apps that combine Shopify + payment processor data help visualize your true profit per order.

Conclusion: Understanding Shopify Fees in 2025

To conclude, the cost of Shopify is based on a percentage of every transaction (maximum of 2) and transaction and credit-card processing. All these selling fees must be taken into consideration in order to control your real profit. The tools of advanced reporting are priceless here: the most advanced Shopify reporting applications are able to consolidate fees and present them in profit dashboards, so that you can see your net sales after each charge.

Try Mipler — the #1 Shopify reporting app. Start your free trial today.

FAQ

Does Shopify receive a percentage of sales?

Yes. Shopify bills subscription fees and platform transaction fees (0–2%) when using non-Shopify payment gateways. Shopify Payments have no platform fee, though standard card processing charges still apply.

How can I reduce Shopify fees?

Use Shopify Payments to avoid the additional 2% charge from third-party gateways. Consider upgrading to a higher plan if your sales volume justifies it (for better card rates). Track and analyze your expenses using analytics tools like Mipler to identify and eliminate unnecessary costs.

Do these charges vary across the globe?

Yes, fees vary by country due to differences in card processing costs and regional regulations. Always confirm your Shopify and payment processor rates are correct for your specific location.

What is the commission rate of Shopify?

The Basic, Shopify, and Advanced plans have respective third-party transaction fees of 2%, 1%, and 0.6%. No platform fees apply when using Shopify Payments.