Aiding Shopify entrepreneurs in legal compliance

Running a successful Shopify store comes with its fair share of responsibilities, and one crucial aspect is tax reporting. As an e-commerce entrepreneur, it's essential to understand the intricacies of tax compliance to avoid legal issues and maintain a thriving business. In this article, we will explore the significance of tax reporting for Shopify customers and introduce Mipler, a powerful application designed to simplify the tax reporting process. By the end of this article, you'll have a solid understanding of tax reporting and be motivated to leverage Mipler's features for seamless tax compliance.

Tax reporting is a fundamental aspect of running a successful Shopify store. Each jurisdiction has its own tax obligations, and failure to fulfill these requirements can result in severe penalties and legal consequences. By diligently reporting and remitting taxes, Shopify store owners can ensure they stay on the right side of the law.

Moreover, accurate tax reporting is vital in maintaining a transparent and professional business image. Customers and stakeholders expect businesses to operate ethically and fulfill their tax obligations. Demonstrating a commitment to tax compliance builds trust with customers and showcases your dedication to being a responsible and law-abiding entrepreneur.

In addition to legal and reputational considerations, tax reporting enables accurate financial record-keeping. Keeping meticulous records of your tax obligations, sales, and expenses is crucial for evaluating the financial health of your Shopify store. These records can also prove invaluable during audits or when seeking financing or partnerships. By maintaining comprehensive tax records, Shopify store owners can gain valuable insights into their business's financial performance and make informed decisions for growth and sustainability.

In summary, tax reporting is crucial for Shopify store owners due to the need for compliance with tax laws and regulations, avoidance of penalties and legal issues, maintenance of a transparent and professional business image, and accurate financial record-keeping. Prioritizing tax reporting not only ensures legal compliance but also instills confidence in customers and provides a solid foundation for long-term success in the e-commerce landscape.

When it comes to tax reporting for Shopify store owners, it's important to have a clear understanding of the various types of taxes that may apply to your business. Here are three common types of taxes that often come into play:

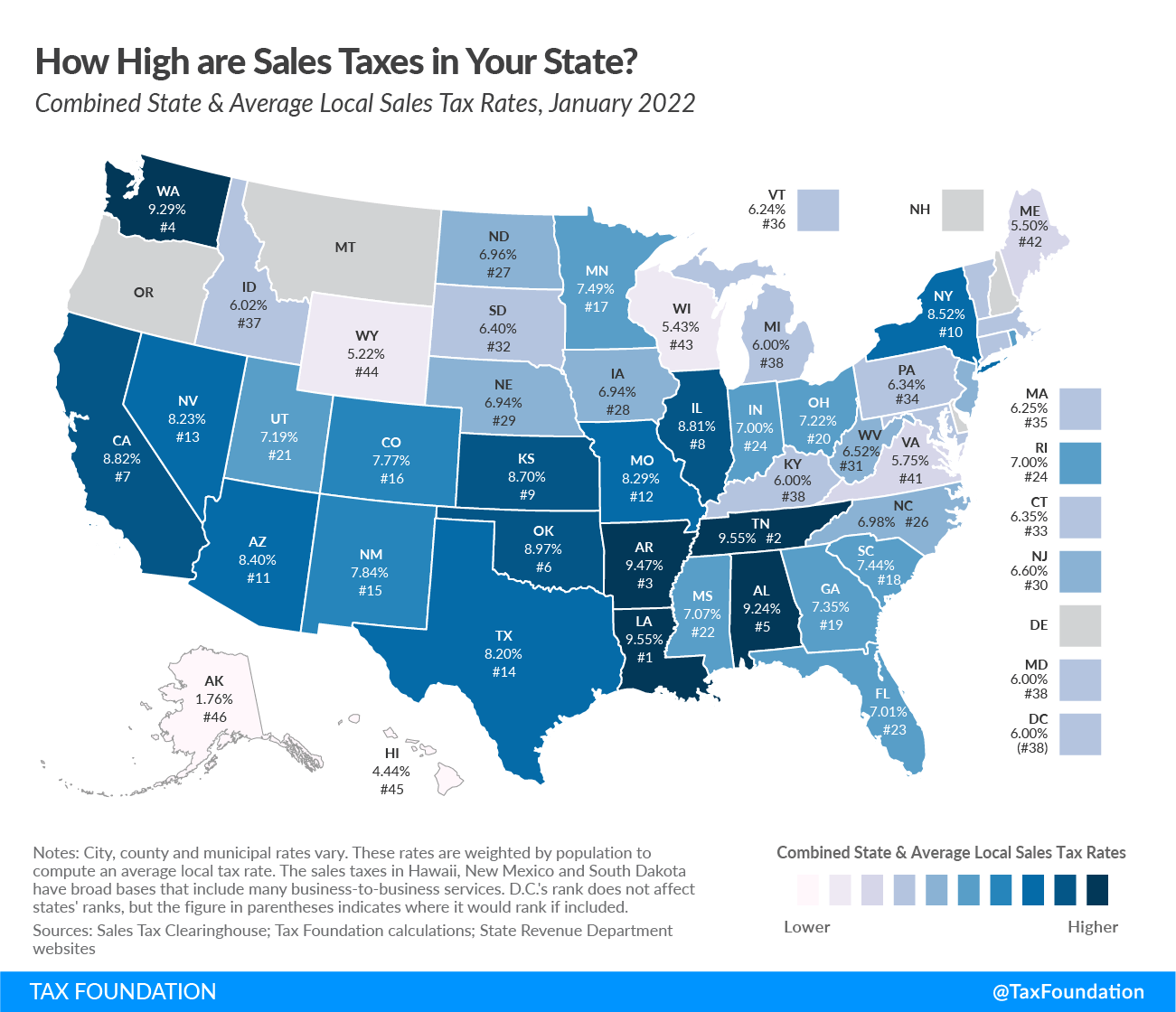

Sales tax: Sales tax is a tax levied on the sale of goods and services. The specific rates and regulations vary from one jurisdiction to another. In the context of e-commerce, sales tax is typically determined based on the customer's location rather than the business's location. This means that as a Shopify store owner, you may be responsible for collecting and remitting sales tax based on the destination of your customers' purchases. Sales tax is a key component of tax reporting, and accurately tracking and reporting the sales tax you collect is crucial to remain compliant.

Value-added tax (VAT): Commonly known as VAT, is a consumption tax imposed on the value added at each stage of the supply chain. Unlike sales tax, which is typically collected at the point of sale, VAT is collected throughout the production and distribution process. The VAT rate and regulations also vary across different jurisdictions. As a Shopify store owner, if you sell products or services internationally or to countries that have a VAT system, you may be required to register for VAT, collect VAT from customers, and report and remit the VAT to the appropriate tax authorities.

By understanding the distinctions between these different types of taxes, Shopify store owners can navigate the complexities of tax reporting more effectively. It's important to stay up-to-date with the tax laws and regulations in the jurisdictions where you operate and ensure accurate tracking and reporting of the relevant taxes to maintain compliance and avoid any potential penalties or legal issues.

When it comes to tax reporting for Shopify store owners in the United States, there are several key considerations to keep in mind. Understanding the US tax system and taking the necessary steps to fulfill your tax obligations is crucial:

The Taxes by Counties report provided by Mipler serves as a powerful tool for Shopify customers, offering valuable insights into their tax obligations and sales performance across different counties. By analyzing the data within the report, Shopify store owners can identify trends and patterns in their sales, allowing them to determine the best and worst days, weeks, months, or years in terms of sales performance.

| OrdersCounty | OrdersNumber of orders | OrdersGross Sales | OrdersDiscounts | RefundsReturns | OrdersNet Sales | OrdersShipping | OrdersTax | OrdersTotal Sales |

|---|---|---|---|---|---|---|---|---|

| Alameda | 3 | $171.54 | $1.76 | $0.00 | $169.78 | $26.85 | $10.46 | $207.09 |

| Albany | 1 | $149.16 | $0.00 | $0.00 | $149.16 | $8.95 | $11.84 | $169.95 |

| Baltimore | 1 | $279.53 | $0.00 | $0.00 | $279.53 | $8.95 | $12.47 | $300.95 |

| Benton | 2 | $339.73 | $0.00 | $0.00 | $339.73 | $17.90 | $19.27 | $376.90 |

| Bergen | 2 | $331.07 | $0.00 | $0.00 | $331.07 | $17.90 | $19.93 | $368.90 |

| Bernalillo | 1 | $191.00 | $8.08 | $0.00 | $182.92 | $8.95 | $11.00 | $202.87 |

| Bexar | 2 | $359.74 | $0.00 | $0.00 | $359.74 | $17.90 | $23.51 | $401.15 |

| Bonneville | 1 | $269.34 | $0.00 | $0.00 | $269.34 | $8.95 | $28.66 | $306.95 |

| Boone | 2 | $434.85 | $0.00 | $0.00 | $434.85 | $17.90 | $24.15 | $476.90 |

| Bristol | 1 | $282.20 | $12.00 | $0.00 | $270.20 | $8.95 | $17.80 | $296.95 |

| Bronx | 3 | $334.63 | $0.00 | $0.00 | $334.63 | $26.85 | $21.37 | $382.85 |

| Broward | 1 | $114.93 | $0.00 | $0.00 | $114.93 | $8.95 | $7.07 | $130.95 |

| Bulloch | 1 | $76.95 | $0.00 | $0.00 | $76.95 | $8.95 | $4.05 | $89.95 |

| Butler | 1 | $240.38 | $0.00 | $0.00 | $240.38 | $8.95 | $16.62 | $265.95 |

| Cabarrus | 1 | $261.31 | $0.00 | $0.00 | $261.31 | $8.95 | $18.69 | $288.95 |

| Calcasieu | 1 | $285.60 | $0.00 | $0.00 | $285.60 | $8.95 | $17.40 | $311.95 |

| Carolina | 1 | $264.49 | $11.04 | $0.00 | $253.45 | $8.95 | $11.51 | $273.91 |

| Cassia | 1 | $82.64 | $0.00 | $0.00 | $82.64 | $8.95 | $5.36 | $96.95 |

| Catawba | 1 | $203.40 | $8.64 | $0.00 | $194.76 | $8.95 | $12.60 | $216.31 |

| Charlottesville | 1 | $104.11 | $4.44 | $0.00 | $99.67 | $8.95 | $6.89 | $115.51 |

| Clark | 6 | $1,080.67 | $15.44 | $0.00 | $1,065.23 | $53.70 | $61.33 | $1,180.26 |

| Clayton | 1 | $267.47 | $11.36 | $0.00 | $256.11 | $8.95 | $16.53 | $281.59 |

| Collin | 1 | $331.84 | $0.00 | $0.00 | $331.84 | $8.95 | $21.66 | $362.45 |

| Columbia | 1 | $144.09 | $0.00 | $0.00 | $144.09 | $8.95 | $8.91 | $161.95 |

| Contra Costa | 4 | $577.31 | $15.56 | $0.00 | $561.75 | $35.80 | $37.69 | $635.24 |

| Cook | 7 | $1,201.41 | $7.12 | $0.00 | $1,194.29 | $62.65 | $73.59 | $1,330.53 |

| Craighead | 1 | $45.24 | $0.00 | $0.00 | $45.24 | $8.95 | $2.76 | $56.95 |

| Cumberland | 1 | $200.51 | $8.52 | $0.00 | $191.99 | $8.95 | $12.49 | $213.43 |

| Dallas | 9 | $1,175.22 | $14.84 | $0.00 | $1,160.38 | $80.55 | $68.77 | $1,309.70 |

| Dane | 1 | $60.80 | $0.00 | $0.00 | $60.80 | $8.95 | $3.20 | $72.95 |

| Dauphin | 1 | $59.22 | $0.00 | $0.00 | $59.22 | $8.95 | $3.78 | $71.95 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 304 | $50,198.98 | $830.09 | $0.00 | $49,368.89 | $2,720.80 | $3,313.92 | $55,403.61 |

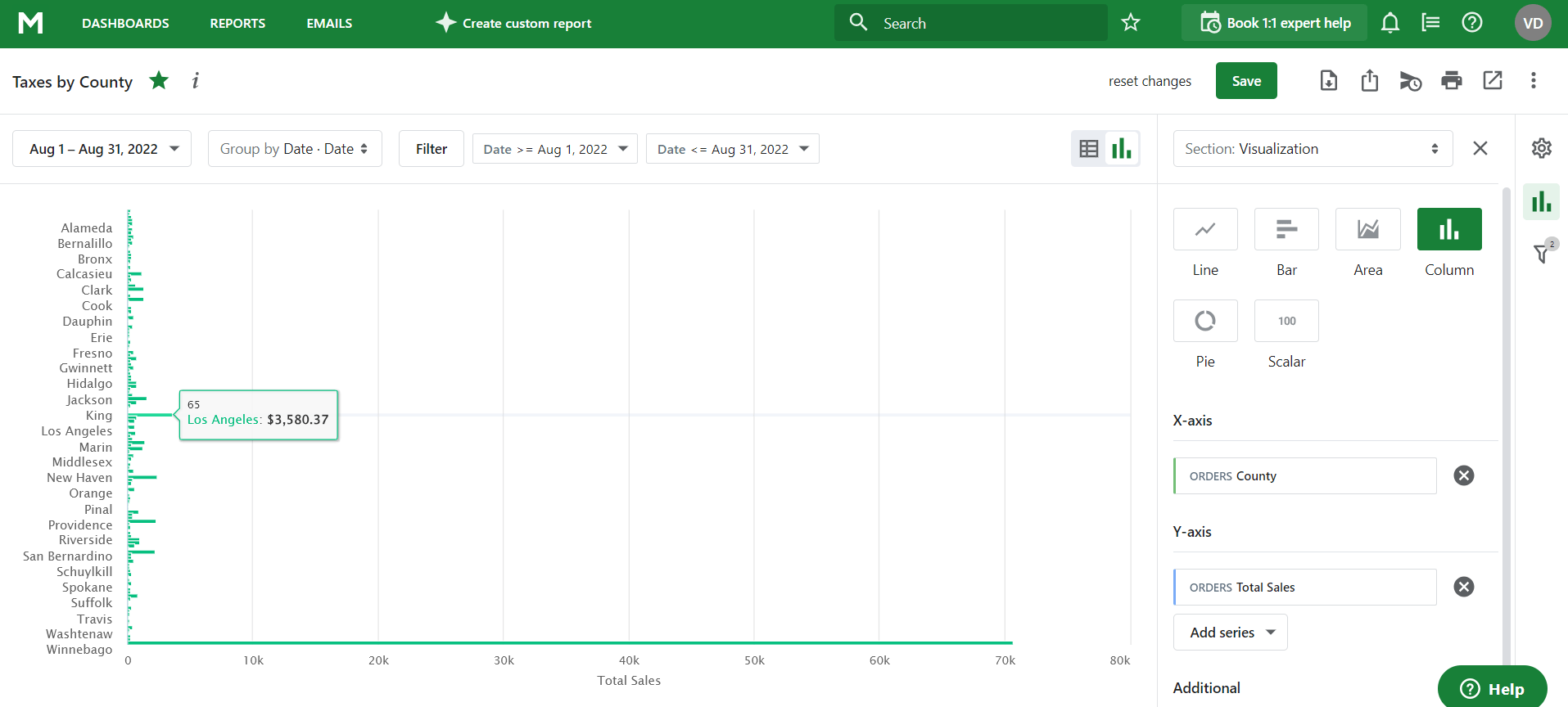

This report goes beyond simple tax calculations by providing a comprehensive breakdown of sales indicators for a specific period. By analyzing this data, Shopify store owners can gain a deeper understanding of their sales trends, pinpointing which counties are driving the highest revenue (in the example below Los Angeles) and identifying areas that require attention.

| OrdersCounty | OrdersNumber of orders | OrdersGross Sales | OrdersDiscounts | RefundsReturns | OrdersNet Sales | OrdersShipping | OrdersTax | OrdersTotal Sales |

|---|---|---|---|---|---|---|---|---|

| Los Angeles | 25 | $3,221.23 | $74.88 | $0.00 | $3,146.35 | $223.75 | $210.27 | $3,580.37 |

| Orange | 11 | $2,121.45 | $4.88 | $0.00 | $2,116.57 | $98.45 | $143.53 | $2,358.55 |

| Richmond | 10 | $2,092.45 | $44.24 | $0.00 | $2,048.21 | $89.50 | $138.55 | $2,276.26 |

| Santa Clara | 10 | $2,028.66 | $24.12 | $0.00 | $2,004.54 | $89.50 | $125.83 | $2,219.87 |

| King | 6 | $1,426.55 | $39.74 | $0.00 | $1,386.81 | $53.70 | $83.94 | $1,524.45 |

| Montgomery | 5 | $1,090.13 | $24.28 | $0.00 | $1,065.85 | $44.75 | $77.87 | $1,188.47 |

| Miami-Dade | 7 | $1,224.19 | $4.56 | $0.00 | $1,219.63 | $62.65 | $77.06 | $1,359.34 |

| Cook | 7 | $1,201.41 | $7.12 | $0.00 | $1,194.29 | $62.65 | $73.59 | $1,330.53 |

| San Bernardino | 5 | $858.19 | $14.60 | $0.00 | $843.59 | $44.75 | $71.78 | $960.12 |

| Dallas | 9 | $1,175.22 | $14.84 | $0.00 | $1,160.38 | $80.55 | $68.77 | $1,309.70 |

| Clark | 6 | $1,080.67 | $15.44 | $0.00 | $1,065.23 | $53.70 | $61.33 | $1,180.26 |

| San Diego | 4 | $901.70 | $34.28 | $0.00 | $867.42 | $35.80 | $57.30 | $960.52 |

| Queens | 5 | $836.05 | $6.16 | $0.00 | $829.89 | $44.75 | $51.95 | $926.59 |

| Macomb | 3 | $647.81 | $21.40 | $0.00 | $626.41 | $26.85 | $51.19 | $704.45 |

| Harris | 5 | $679.02 | $20.12 | $0.00 | $658.90 | $44.75 | $50.98 | $754.63 |

| Jefferson | 4 | $689.65 | $17.96 | $0.00 | $671.69 | $35.80 | $49.34 | $756.83 |

| Tarrant | 5 | $786.92 | $21.40 | $0.00 | $765.52 | $44.75 | $47.08 | $857.35 |

| San Francisco | 3 | $528.48 | $5.13 | $0.00 | $523.35 | $26.85 | $44.02 | $594.22 |

| Kings | 5 | $666.03 | $4.92 | $0.00 | $661.11 | $44.75 | $42.97 | $748.83 |

| Jackson | 3 | $709.46 | $12.16 | $0.00 | $697.30 | $26.85 | $41.54 | $765.69 |

| Philadelphia | 3 | $518.12 | $14.20 | $0.00 | $503.92 | $26.85 | $38.88 | $569.65 |

| Marion | 2 | $584.93 | $17.52 | $0.00 | $567.41 | $17.90 | $38.07 | $623.38 |

| Contra Costa | 4 | $577.31 | $15.56 | $0.00 | $561.75 | $35.80 | $37.69 | $635.24 |

| Madera | 2 | $526.51 | $0.00 | $0.00 | $526.51 | $17.90 | $35.49 | $579.90 |

| Napa | 4 | $451.24 | $0.00 | $0.00 | $451.24 | $35.80 | $31.76 | $518.80 |

| Seward | 3 | $439.19 | $14.52 | $0.00 | $424.67 | $26.85 | $29.81 | $481.33 |

| Seminole | 1 | $298.29 | $0.00 | $0.00 | $298.29 | $8.95 | $29.71 | $336.95 |

| Richland | 2 | $386.94 | $2.56 | $0.00 | $384.38 | $17.90 | $29.06 | $431.34 |

| Gwinnett | 2 | $431.03 | $0.00 | $0.00 | $431.03 | $17.90 | $28.97 | $477.90 |

| Rains | 1 | $370.04 | $15.96 | $0.00 | $354.08 | $8.95 | $28.96 | $391.99 |

| Bonneville | 1 | $269.34 | $0.00 | $0.00 | $269.34 | $8.95 | $28.66 | $306.95 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 304 | $50,198.98 | $830.09 | $0.00 | $49,368.89 | $2,720.80 | $3,313.92 | $55,403.61 |

This information enables informed decision-making, allowing entrepreneurs to focus their marketing efforts on regions with the most potential, optimize inventory management strategies, and tailor business operations to specific county requirements.

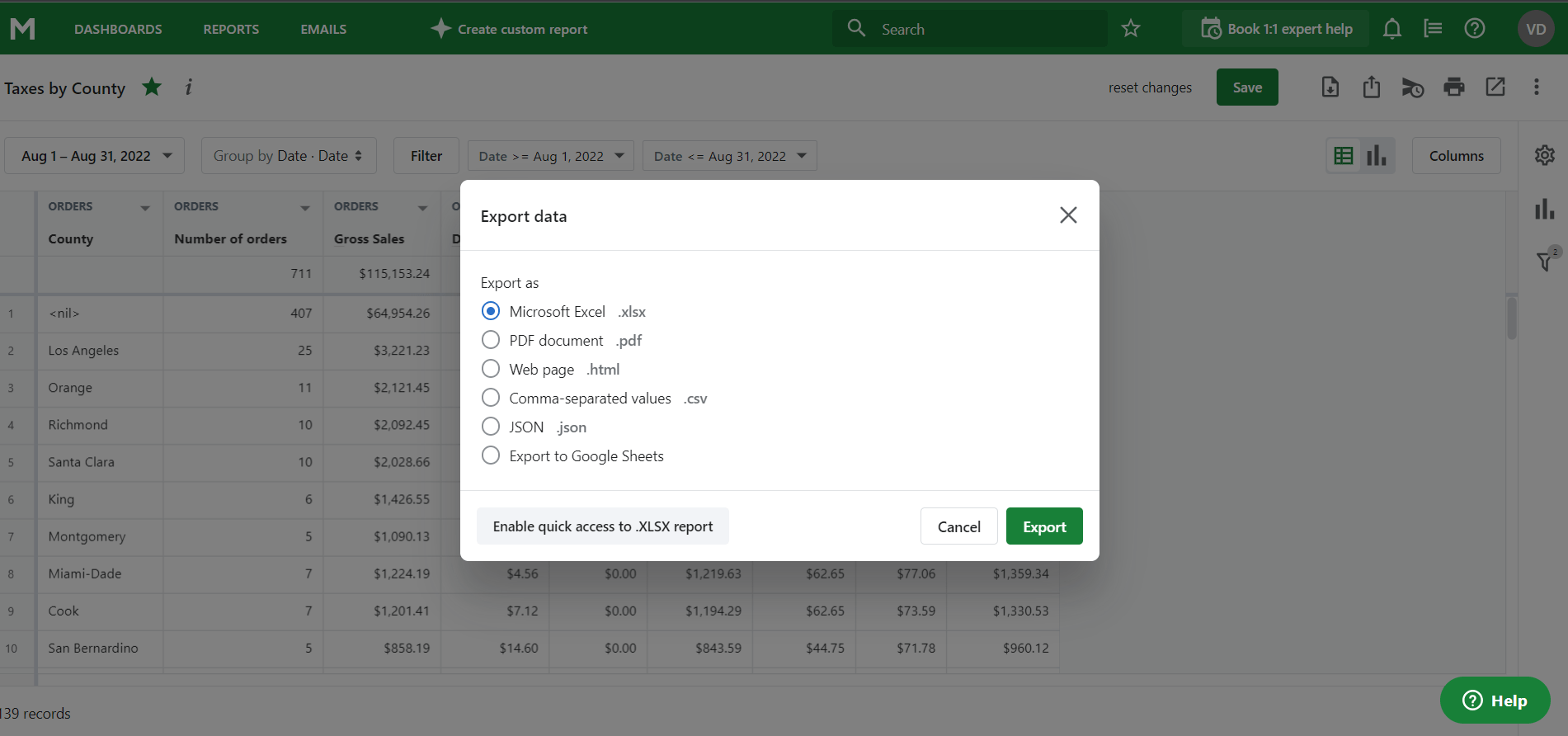

The Taxes by Counties Mipler report provides Shopify customers with the flexibility to export the data in various formats, making it convenient for further analysis and integration into their workflow.

With Mipler, users can easily export the report in formats such as Microsoft Excel (.xlsx), PDF (.pdf), web page (.html), comma-separated values (.csv), and JSON (.json). This wide range of export options ensures compatibility with popular software applications and allows for seamless data manipulation, sharing, and collaboration.

Additionally, Mipler also offers the option to directly export the report to Google Sheets, enabling users to leverage the power of cloud-based spreadsheets for dynamic analysis and real-time collaboration.

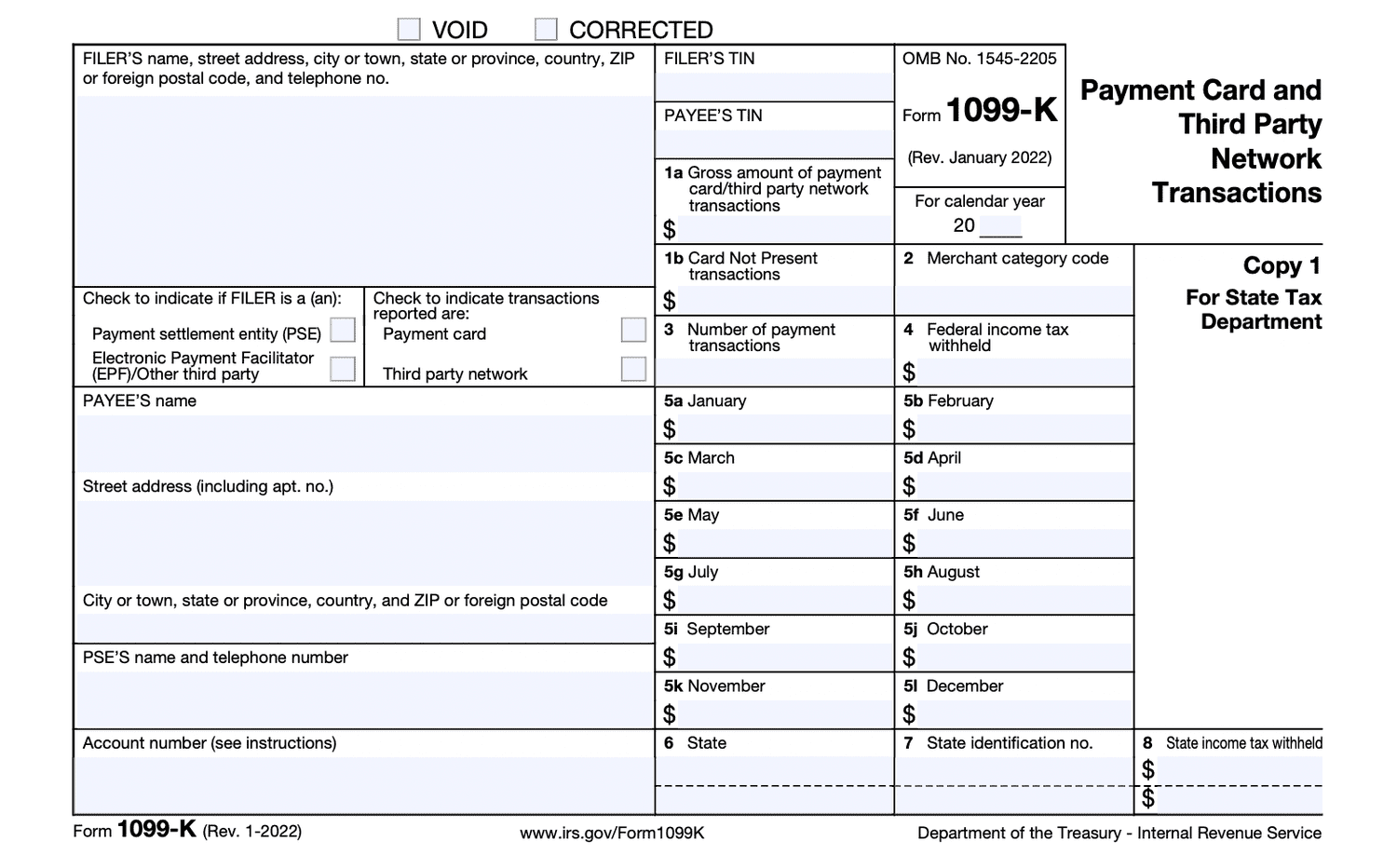

This form is used to report payments received throughout the year from credit, debit, or stored value cards (such as gift cards) and payments processed through payment apps or online marketplaces, which are referred to as third-party payment networks. It's important to note that third-party payment networks are required to file Form 1099-K with the IRS and provide a copy to you when the total gross payment amount exceeds $600 in a calendar year.

However, it's worth mentioning that Form 1099-K should not include gifts or reimbursements for personal expenses received from friends and family. This form focuses on payments received through official payment channels. As a Shopify store owner, being aware of the thresholds and requirements associated with Form 1099-K can help ensure accurate tax reporting and compliance with IRS regulations.

Example of Form 1099-K:

While federal tax laws apply uniformly across the United States, individual states have their own distinct tax rules that must be followed. This includes variations in sales tax rates, exemptions, thresholds for sales tax nexus, and filing deadlines. It is essential for Shopify entrepreneurs to invest time in researching and comprehending the tax rules of each state where they have a sales tax obligation. This can be achieved by reviewing state-specific tax websites, consulting with tax professionals who specialize in multistate taxation, or utilizing advanced tax software that keeps track of state-specific regulations.

By understanding the tax rules for each state, Shopify store owners can accurately calculate and collect sales tax, properly report their sales tax liabilities, and ensure timely remittance to the respective state tax authorities. Failure to comply with state tax rules can result in penalties, fines, or even legal repercussions, highlighting the importance of staying up-to-date with the tax laws of each state in which they conduct business.

Furthermore, maintaining compliance with state tax regulations helps build a trustworthy business image, instilling confidence in customers and fostering positive relationships with state tax authorities. Overall, a comprehensive understanding of the tax rules for each state is essential for Shopify store owners to navigate the complexities of multistate taxation and effectively manage their tax reporting obligations.

California's tax system is a complex and multifaceted one, with various tax rates, collections, and burdens that impact individuals and businesses. Understanding the basics of California's tax code is crucial for navigating its tax landscape.

Here is an overview of some key aspects of California's tax system:

An In-Depth Look at UK Taxes: Corporate Tax, VAT, Income Tax, National Insurance, PAYE, and Dividend's Tax

Corporation tax is applicable to businesses registered within the UK. Overseas entities without a permanent establishment in the UK continue to pay corporation tax in their country of incorporation. Currently, the UK corporation tax rate stands at 19%. However, starting from April 2023, this rate is expected to increase to 25% for UK companies with profits exceeding ВЈ250,000. Smaller UK companies with profits up to ВЈ50,000 will continue to pay corporation tax at 19%, while profits falling between these two figures will be subject to a tapered rate. This tax is levied on all business profits from the UK and abroad.

Value-added tax. The UK has three different VAT rates: the standard rate of 20% applies to most products, the reduced rate of 5% applies to certain health products and car seats for children, and the zero rate of 0% applies to food, books, and children's clothing. Merchants should apply the appropriate VAT rate depending on the product they intend to sell.

Income Tax: Income tax is paid to the UK government based on annual income. Individuals pay income tax on the money earned from employment or profits made if they are self-employed. The payable tax rates are as follows:

National Insurance is a tax on earnings and self-employed profits applicable only to UK tax residents. NI contributions are paid into a fund that supports certain state benefits. The rates for NI deductions are as follows: 12% for basic rate employees, an additional 2% for higher rate employees, and 13.8% for employers. Some eligible employers can apply for employment allowance, which covers their NI up to ВЈ5,000 per year. NI deductions vary based on salary income and are a statutory requirement.

Pay as You Earn (PAYE) deducts income tax from an employee's pay. The three buckets of PAYE deduction rates are the basic rate of 20%, the higher rate of 40%, and the additional rate of 45%, depending on the employee's earnings. The percentages for income tax can differ between England, Scotland, and Wales. Both NI and PAYE deductions are applicable to employees residing in the UK as their permanent base. Employees working for a UK company but residing outside of the UK may need to investigate double tax treaties to ensure proper tax compliance.

Dividends are payments made to company shareholders from retained earnings. Directors often remunerate themselves through a combination of salary and dividends to optimize tax efficiency. The business distributing dividends is not liable for tax on the dividends issued. However, shareholders must pay income tax on the dividends they receive through a self-assessment. Currently, shareholders can receive up to ВЈ2,000 tax-free in dividends, but for the 2023/24 tax year, this will reduce to ВЈ1,000 tax-free. Dividends received by non-UK tax residents are not subject to UK income tax, but recipients may be liable to pay income tax on the received dividends in their country of residence.

Company tax, also known as corporation tax, is a crucial component of the tax system for various types of entities, including companies, clubs, co-operatives, and unincorporated associations operating within the European Union (EU). The rules governing company tax are determined by national authorities and can vary across member states.

When examining the corporate income tax rates among European OECD countries, it becomes evident that there is significant variation. Portugal boasts the highest statutory corporate income tax rate, standing at 31.5 %. Following closely behind are Germany at 29.8 % and Italy at 27.8%. On the other end of the spectrum, countries such as Hungary, Ireland, and Lithuania enjoy the lowest corporate income tax rates, set at 9%, 12.5%, and 15%, respectively.

On average, European OECD countries currently impose a corporate income tax rate of 21.5 %. While this average falls slightly below the worldwide average of 23.4% across 180 jurisdictions in 2022, it still demonstrates the significance of corporate taxation in Europe.

Over the past few decades, European countries, much like other regions worldwide, have witnessed a decline in corporate income tax rates. However, in recent years, the average corporate income tax rate in Europe has stabilized. Among the 27 European countries, only the Netherlands has increased its corporate income tax rate in the past year, a trend that is expected to continue as countries explore more efficient tax alternatives.

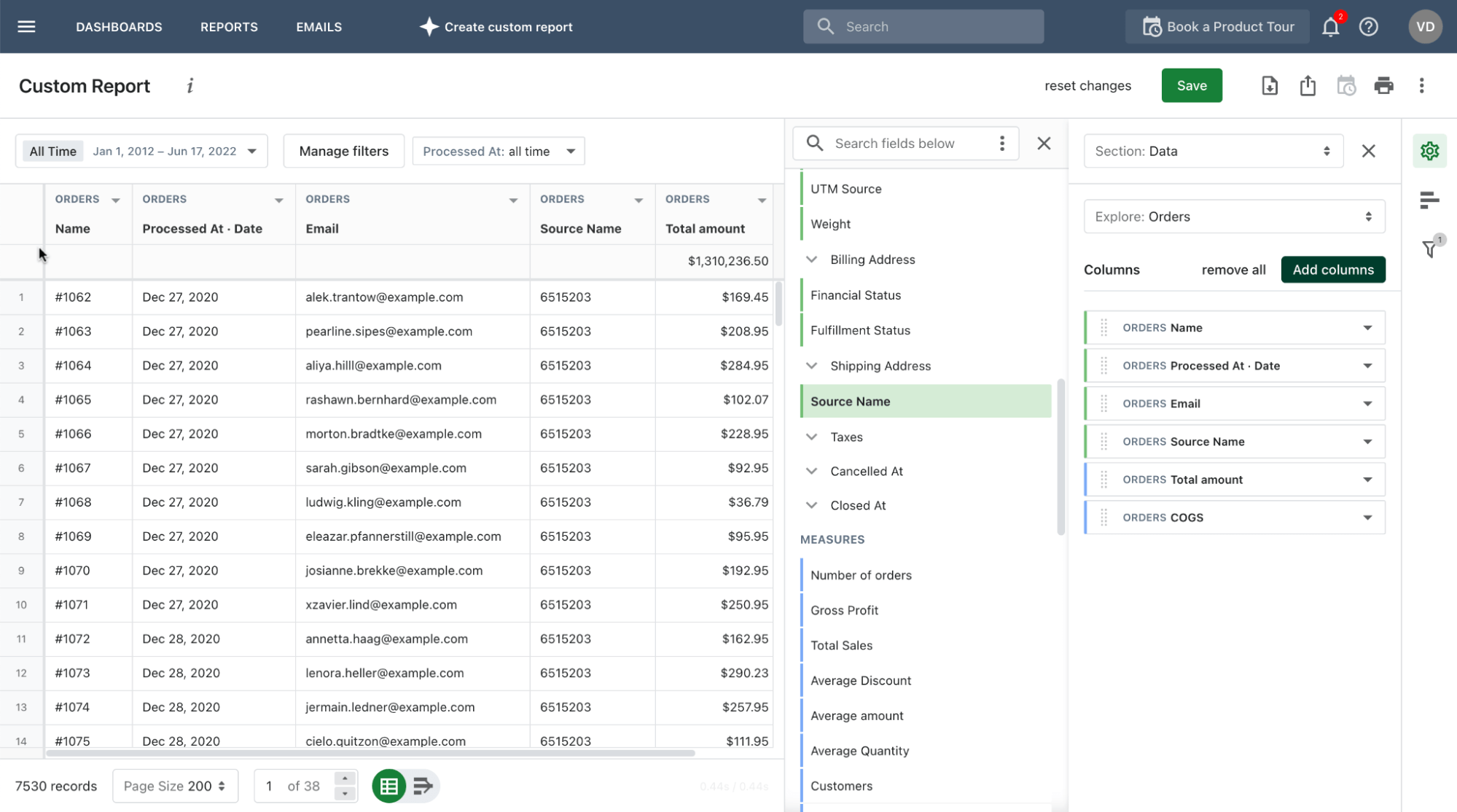

Mipler offers a comprehensive suite of features designed to streamline and simplify the tax reporting process for Shopify customers. One of the key advantages of using Mipler is its ability to automate routine data collection tasks, resulting in significant time savings. With Mipler, you can say goodbye to manual data entry and spend those precious hours on more important aspects of your business.

Whether it's tracking orders pending fulfillment, optimizing production planning, or monitoring inventory at risk, Mipler can automate these processes and generate relevant reports tailored to your specific business needs. A real-life example demonstrates the impact of Mipler's automation capabilities. Mipler empowers Shopify customers to leverage automation and unlock greater efficiency in their tax reporting workflow, ultimately enabling them to focus on growing their business.

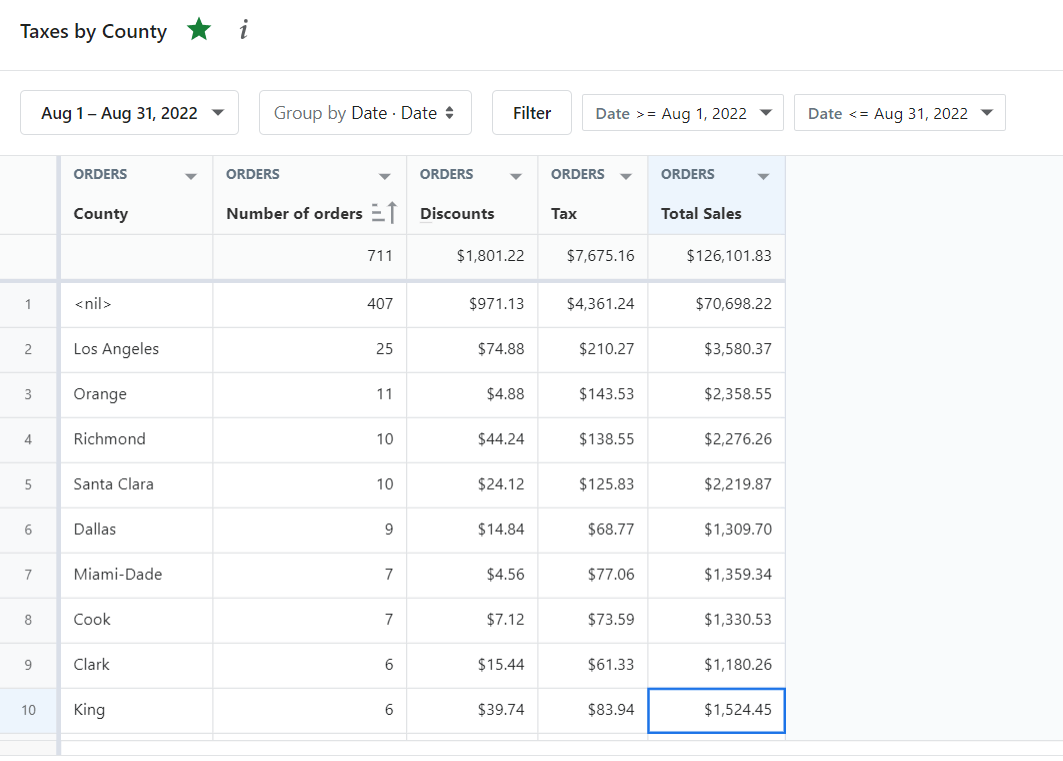

At the top of the sheet, there are clear headings that indicate the columns, starting with "County" as the first column. This column lists the different counties where the orders were made, allowing users to identify the geographical distribution of their sales.

The subsequent columns provide essential information for each county, including the "Number of Orders," which indicates the total count of orders received from each county. This metric helps users gauge the volume of business activity within specific regions.

Another significant column is "Discounts," which displays the total value of discounts applied to the orders within each county. This information allows users to track the impact of discounts on their overall sales and evaluate the effectiveness of promotional strategies.

The "Tax" column provides a clear breakdown of the tax amount associated with each county. This enables users to understand the tax liability associated with their sales in different regions, helping them with accurate tax reporting and compliance.

Lastly, the "Total Sales" column summarizes the overall sales generated from each county. This figure represents the total revenue generated before any discounts or taxes are applied, giving users a comprehensive overview of their sales performance across different regions.

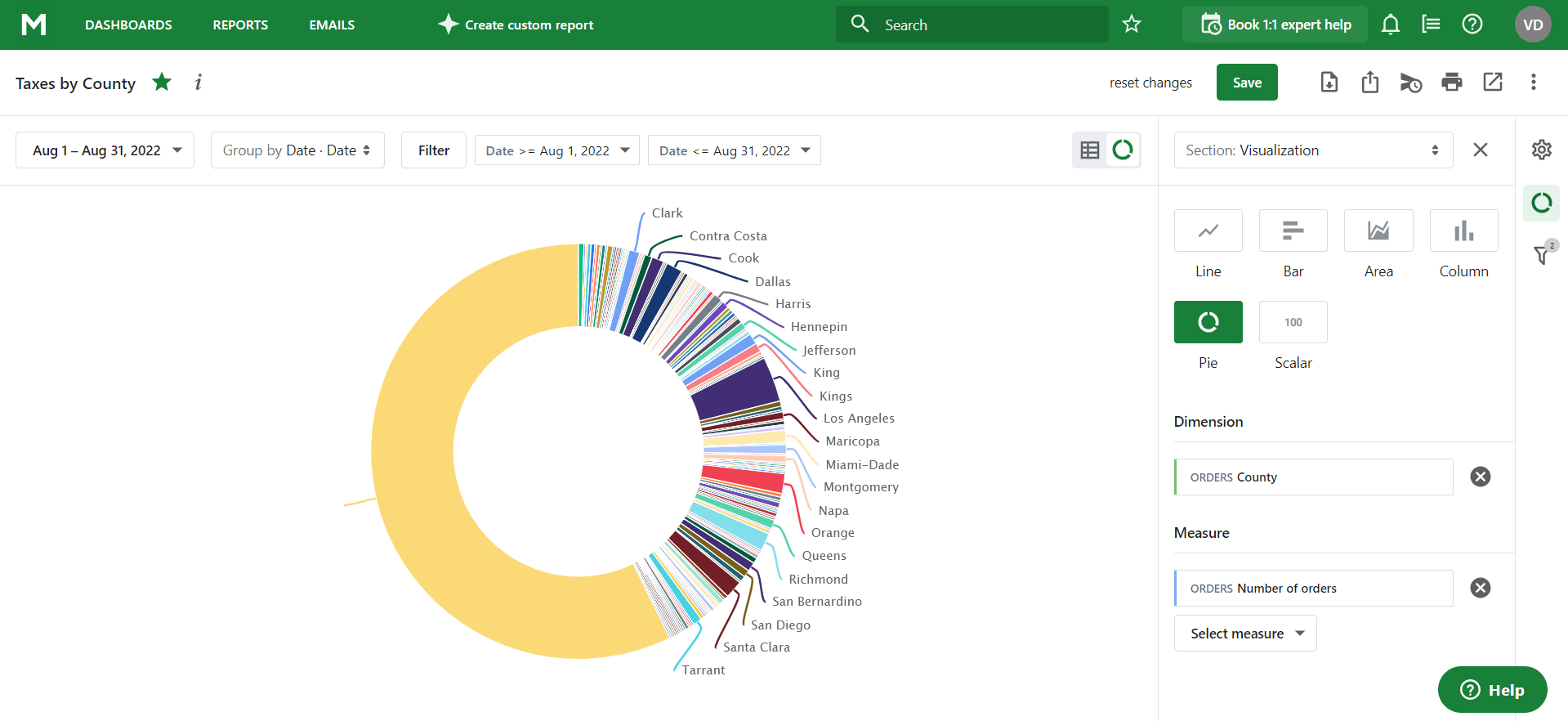

Mipler offers a range of visualization options to enhance the understanding and presentation of tax reporting data. Users have the flexibility to choose from various chart types, including line, bar, area, column, pie, and scalar charts.

Line charts are useful for tracking trends over time. They allow users to visualize the progression of sales, tax amounts, or other metrics across different periods, making it easier to identify patterns and fluctuations.

Bar charts are ideal for comparing values across different categories or counties. Users can quickly assess the variations in the number of orders, discounts, tax amounts, or total sales between different regions, providing a clear visual representation of the differences.

Area charts, similar to line charts, show the progression of data over time. They are particularly effective in highlighting the cumulative sales or tax amounts across different periods, allowing users to understand the overall growth or decline in their business.

Column charts are suitable for comparing values between different categories or counties in a more visually impactful way. Users can easily compare the number of orders, discounts, tax amounts, or total sales side by side, providing a clear understanding of the variations.

Pie charts are valuable for representing the composition of sales or tax amounts across different categories or counties. Users can quickly grasp the relative proportions and distributions of their revenue or tax liability, making it easier to identify the most significant contributors.

Scalar charts, also known as number charts, provide a concise representation of specific metrics. They display the numerical values associated with different categories or counties, allowing users to quickly assess the exact figures without the need for complex visualisations.

We want to provide value for all our customers. Start with a call to discover how we can help your business.