Introduction

The owner of a new store usually needs to make many adjustments, not only in the official part of the work. They rent premises, configure the Shopify platform for their needs, configure the website, and sign contracts with suppliers. We would like to help young shops go through this path as painlessly as possible.

Taxes are a very important part of business. Properly setting up taxes in Shopify saves you time from calculating them yourself. The exact configuration of taxes not only allows you to stay in legislation but also very often helps to shape the price of goods.

In this article, we'll look at Shopify tax setup and provide step-by-step setup instructions.

Understanding Tax Settings in Shopify

Shopify has one feature - it does not pay taxes instead of owners, like Amazon or eBay. Accordingly, you are responsible for calculating taxes and sending declarations.

However, Shopify helps you track taxes and consider all the nuances of legislation. Your taxes depend on the following factors:

- Place of store registration

- Location of customers

- Country or state tax laws

Accordingly, you need to indicate where it is located in the store settings. If you plan to sell abroad, then you need to specify where the parcels will be sent.

As a seller, you can collect sales taxes and then report and remit those taxes to the government. Although tax laws and regulations are complex and can change frequently, you can set up Shopify to automatically handle the most common sales tax calculations. You can also customize tax overrides to account for unique tax laws and situations.

By default, Shopify uses your store location to determine applicable tax rates. For example, if your store is based in the US, Shopify automatically applies sales tax according to state requirements. However, additional adjustments are required in more complex scenarios, such as selling overseas or handling duty-free goods.

Setting Up Taxes in Shopify

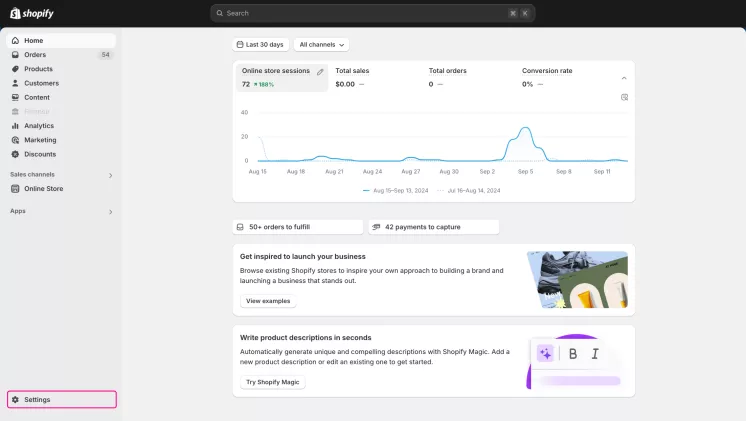

Step 1: Accessing Tax Settings

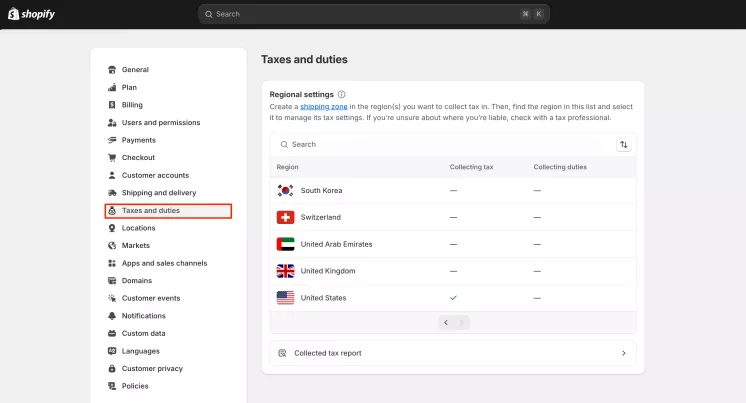

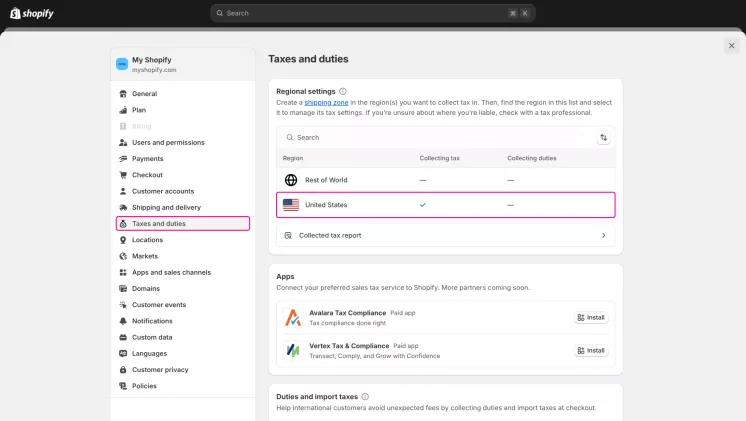

- To regulate your taxes, go to Settings in the admin panel of the store

- Choose Taxes and Duties

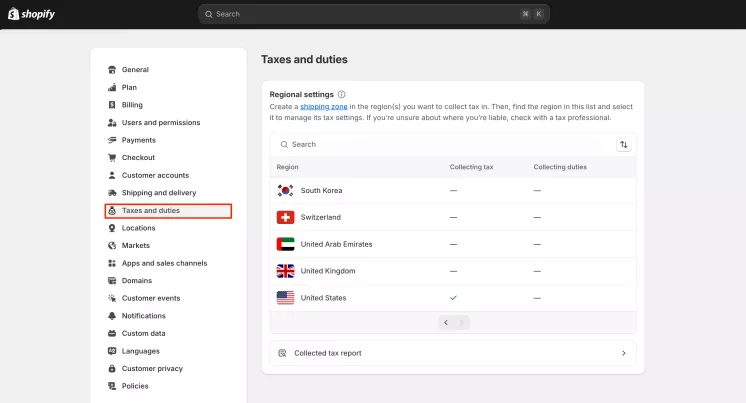

After that, you get to a page where you can see:

- Regions in which you sell goods and pay taxes

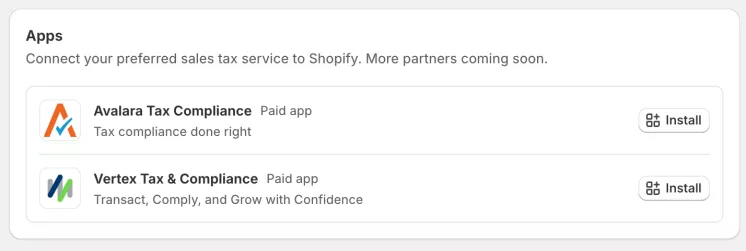

- Apps that help you determine your tax jurisdictions

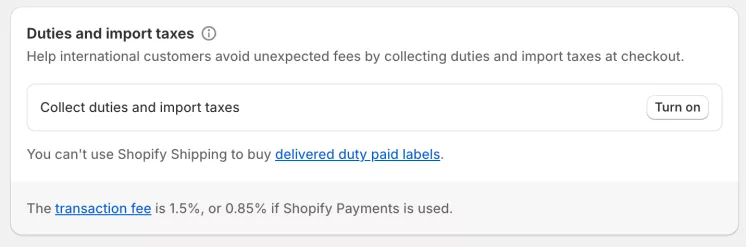

- Setting customs duties and taxes on imports

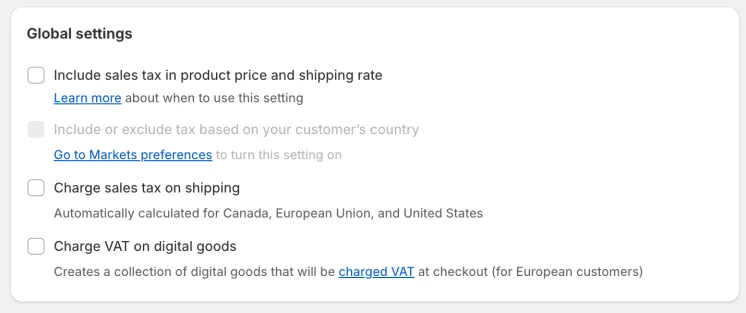

- Global settings by type whether or not to include your taxes in the product price and shipping cost.

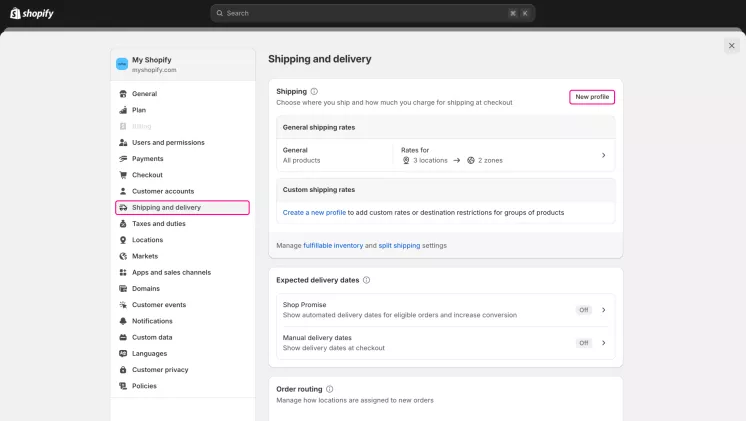

Step 2: Configuring Tax Regions

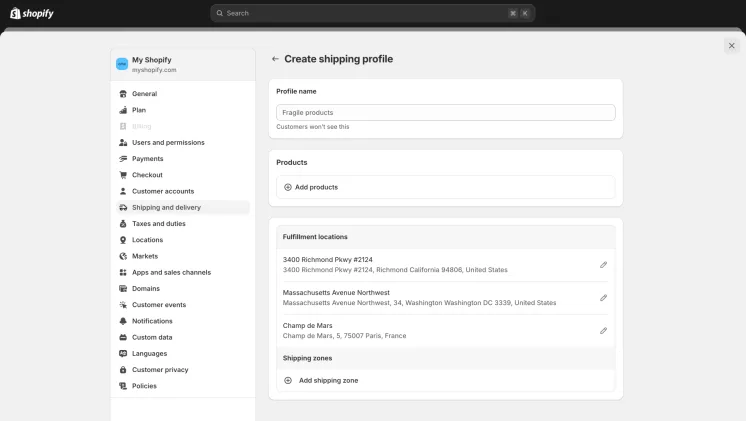

To configure the regions in which you sell goods, you need to go to the Shipping and delivery tab.

- In the Shipping section, click the shipping profile that you want to add shipping zones to.

- Next to the group of locations where you want to add a shipping zone, click Create zone.

- Enter a name for the shipping zone.

- Select the countries and regions that you want to be in the zone.

- Click Done.

- Add any rates that you want for the zone, and then click Save.

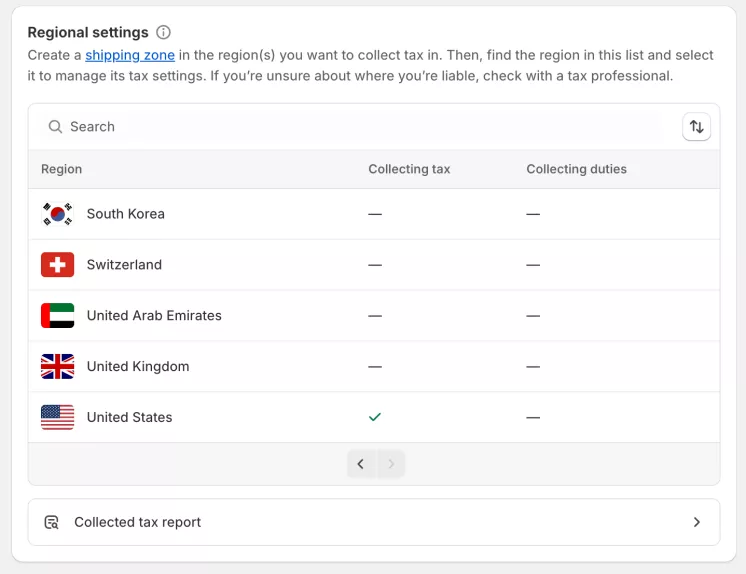

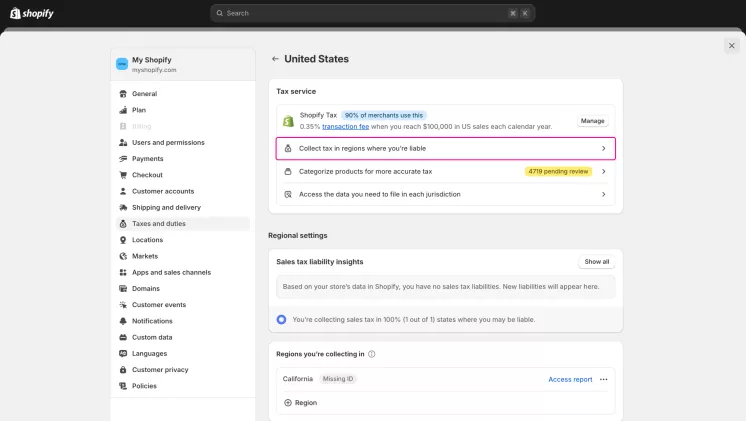

Step 3: Setting Tax Rates

After setting up the regions, it's time to set the specific tax rates. You can edit the tax rate for each region according to the applicable rules. For example, in the US, some states have different rates for clothing or digital goods. Adjust these rates accordingly to comply.

- In Taxes and Duties choose the name of the country where you want to set the specific tax rate.

- To manage your specific taxes for regions

Step 4: Applying Tax Exemptions

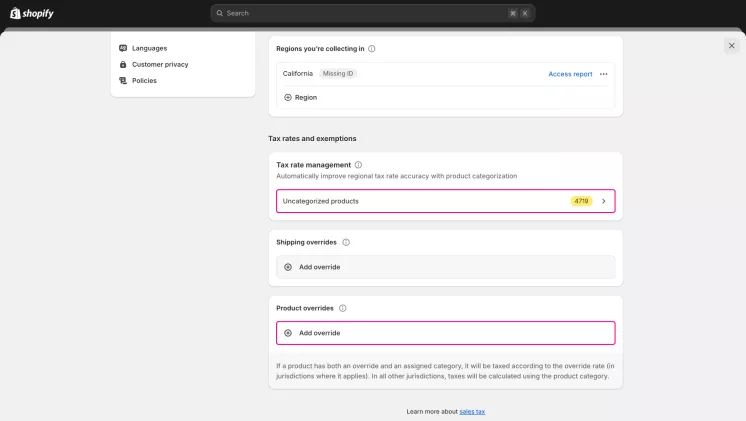

- In Taxes and Duties choose the name of the country where you want to set the specific tax rate.

- Scroll down to the Tax rates and exemptions.

- To apply tax exemptions for products choose the Tax rate management or add new Product overrides.

Troubleshooting Common Tax Issues

Common Problems and Solutions

Of course, nothing works perfectly. Despite your best efforts, setting up taxes can cause problems. And even small errors can lead to significant problems. Here are some common issues you might encounter and tips on resolving them.

Incorrect tax rates applied to orders

Issue: Tax rates may display a different amount due to regional differences or incorrectly configured settings.

Solution: Check your tax settings regularly to make sure they match the latest rates for each region you serve. Use Shopify's tax override feature to adjust your rates when the default settings don't apply. Always check your tax rates with the latest local tax rules.

The tax is not displayed during checkout

Problem: Customers may not see the correct taxes at checkout, especially when selling internationally or processing digital products.

Solution: Check that your tax settings are configured correctly for all regions where you operate. Make sure your products are classified correctly, as digital goods and services often have different tax requirements. Also, review your customer settings to ensure that tax credits are not being applied incorrectly.

Incorrect tax benefits

Issue: Certain products or customers may be erroneously tax-exempt, resulting in lost revenue or compliance issues.

Solution: Double-check your tax settings for products and customers, making sure exemptions only apply where required by law. Review your tax exemption settings regularly, especially after changing your product catalog or customer segments.

Problems with taxation of digital goods

Problem: Digital goods often have unique tax rules that differ from physical goods, causing potential compliance issues.

Solution: Make sure your Shopify store is set up to account for VAT and other relevant taxes for digital products. Use Shopify's tax limits to set specific bids for digital items as needed. Stay updated with the latest tax laws that apply to digital products in your sales territories.

When to Seek Help

Not all problems can be solved on your own. Sometimes you need to ask Shopify or Mipler for help. We have collected for you several situations that may signal that you need to seek help:

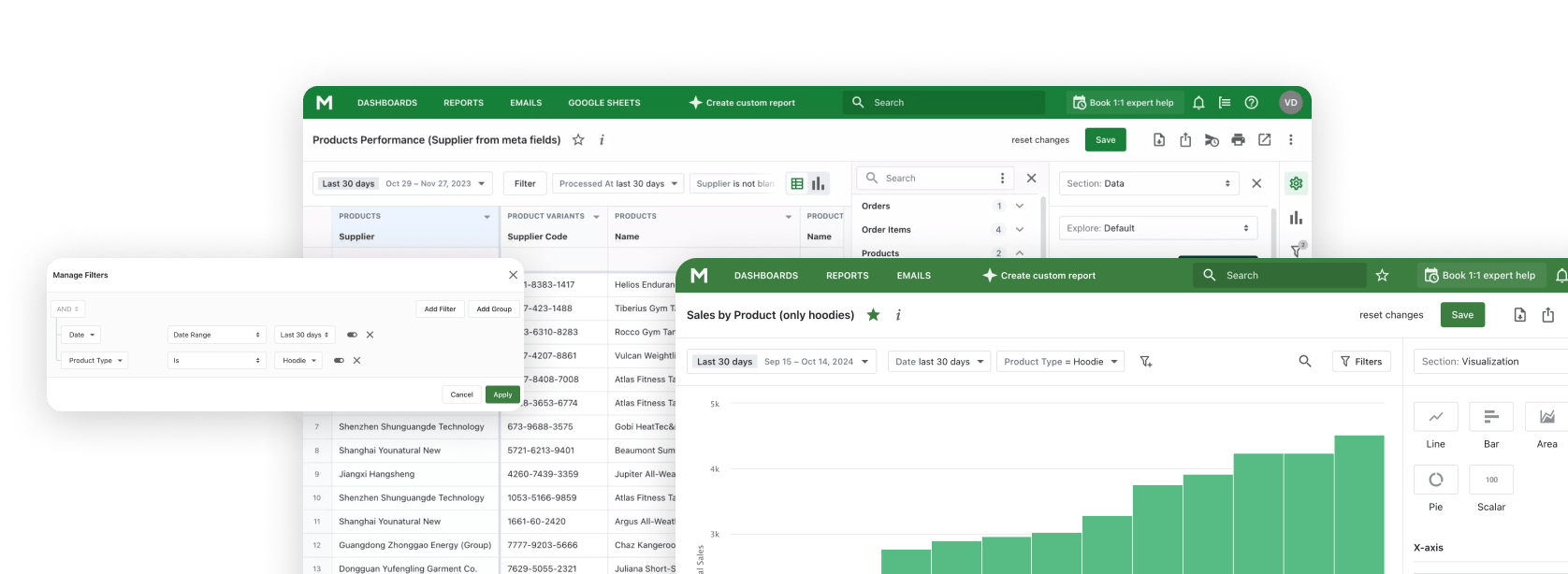

- Persistent Errors: If you are repeatedly experiencing problems with taxes or Shopify Custom Reports that cannot be generated.

- Complex tax scenarios: If your business operates in multiple jurisdictions with fast-track tax laws.

- Audits and Response: If you need to ensure a full response to tax legislation.

- Technical difficulties with reporting: If you struggle to create accurate Shopify Tax Reports, consider Mipler, which offers more detailed and customizable reporting options.

Conclusion

Getting your taxes right in Shopify is essential to your business. In this way, you can protect yourself from possible problems. In this article, we have considered many aspects of tax management. The main thing you need to do so that everything goes correctly is periodically check whether the settings have gone astray.

Shopify's built-in tools provide a solid foundation for tax management. However, there are situations in which your business needs more information. Mipler gives you more options to analyze your taxes. And it also allows you to make the adjustments you need.

Remember that setting up your taxes correctly isn't just about compliance; it's about optimizing your store and building customer trust. Feel free to explore Mipler's capabilities and seek professional help as needed to ensure your Shopify tax setup is accurate and efficient.