The procedure of handling Shopify state sales tax across multiple states poses many challenges to sellers who operate on the Shopify platform. The distinct rules and filing methods between states make it necessary to maintain proper organization to prevent penalties for taxpayers. Each state has its rules about sales tax reporting requirements, so you need to track and file taxes individually for all jurisdictions where your business operates below state-level thresholds.

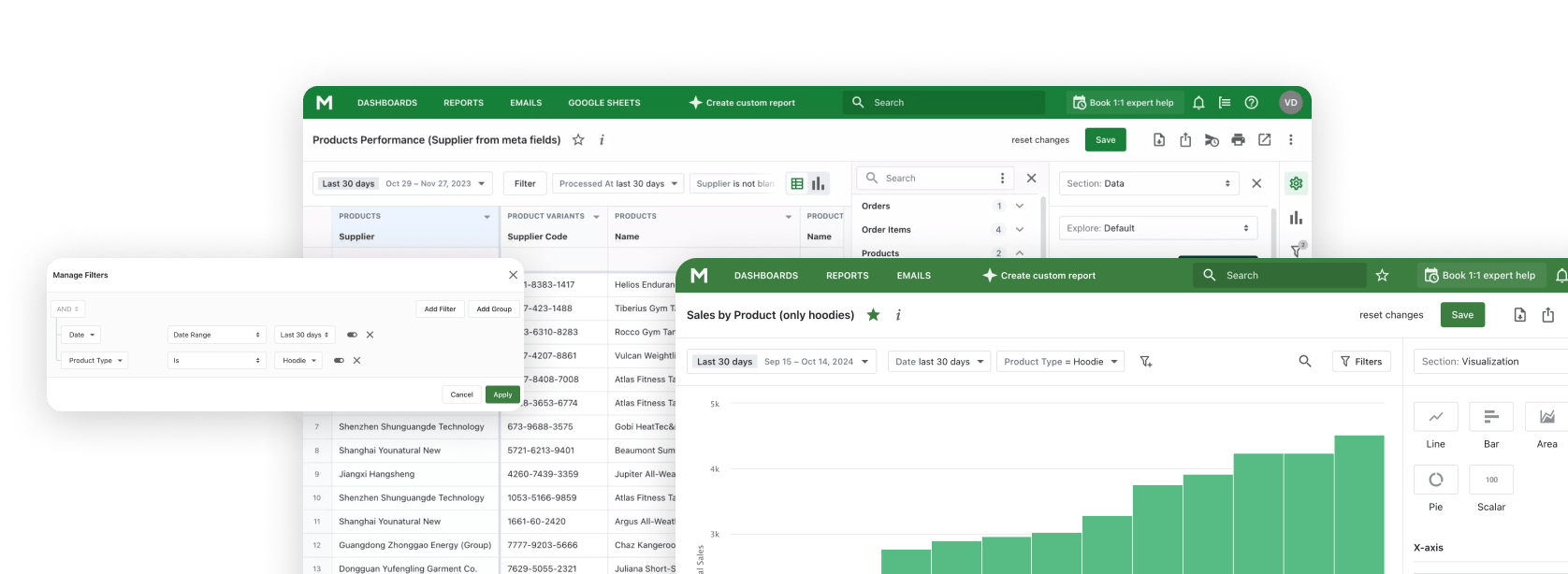

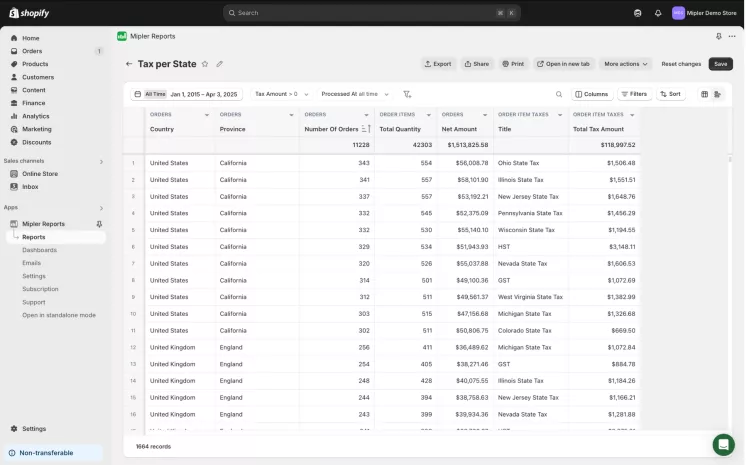

A Shopify Tax per State report serves as the solution for managing state sales tax among all states. The Shopify taxes by state are presented by state through this report, which provides precise totals for each specific state. Mipler's Shopify Reports provide an easy method to create automated reports, which allows you to handle Shopify state sales tax across all states with certainty.

Why the Shopify Tax per State Report is Important

A Shopify state sales tax report consolidates all taxes you've collected for each state, which is vital for compliance. Without a clear breakdown, you might overlook or miscalculate what you owe to different states. Using this report helps ensure you meet all sales tax reporting requirements by state and avoid any fines.

A Shopify state sales tax report gathers all tax revenue collected within each state to support compliance purposes. A lack of proper breakdowns between states can lead you to fail in accurately accounting for your payments to different regions. Your business can avoid unnecessary tax findings when you use these sales tax reporting requirements by state to fulfill all tax filing responsibilities.

Benefits of the Shopify Tax per State Report

- Easy multi-state compliance: A Shopify state sales tax report displays all states in one interface to provide necessary records for meeting state filing requirements. This system will help you fulfill all sales tax reporting requirements by state efficiently through automated processes.

- Time-saving automation: Shopify state sales tax report simplifies the tax calculation process by automatically generating the data without manual labor. You will save hours of labor and your totals will have fewer errors with this feature enabled.

How the Shopify Tax per State Report Helps You

Use Shopify state sales tax report functions like a navigational tool for tax compliance responsibilities. This report displays your store's tax collection areas in specific detail to avoid missing states while filing taxes despite unknown state rules. It also allows you to detect growing sales activity in new regions, which signals an approaching tax collection threshold.

Create a Shopify Tax per State Report with Mipler

- Open Mipler in your Shopify admin.

- Find the "Tax per State Report" in Mipler Report section.

- Select your date range (e.g., today, last 7 days, last month or year).

- Run the report to see a Shopify taxes by state breakdown – each state and its tax collected will be listed.

- Export the report: Download the report as a spreadsheet, PDF or other format which you prefer to keep records or share with your accountant.

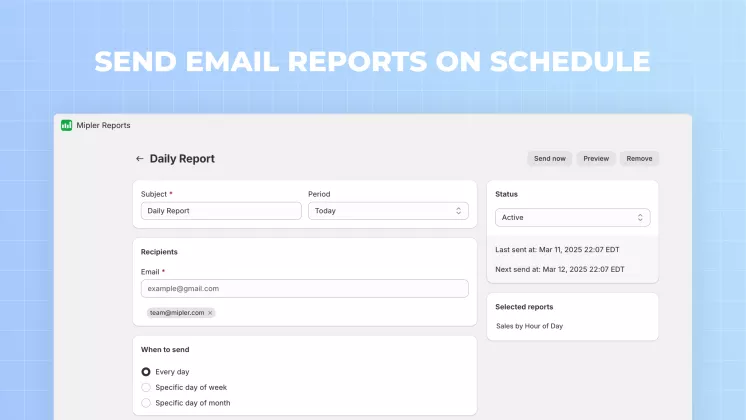

Automate Your Shopify Tax per State Report to Optimize Your Store

Generating many Shopify Tax Reports manually is helpful, but automation takes it further. Mipler lets you schedule the report to email you automatically (e.g., monthly or quarterly), so you always have the latest data for each state without any reminders. By automating Shopify and state sales tax reports, you'll save time and ensure consistency. Essentially, Shopify sales reporting states taxes become as simple as checking your inbox, letting you focus on growing your business instead of crunching numbers.

Important

You can verify tax amounts and maintain correct settings through Shopify Sales Reportsprovided by Mipler. Try to avoid big amounts of manual work by enabling automatic reports into your routine and add tax per state report to your list of must-have insights which you need to work with.

FAQ

What is the Shopify Order Items Report?

Shopify has a built-in tax engine that calculates tax at checkout based on the customer's location and product type. You need to specify which states to collect tax for in your Shopify settings, and Shopify will automatically apply the right rates for those states. Shopify and state sales tax calculations are handled by Shopify once you set it up.

How often should I generate this report?

No. Shopify can calculate and collect taxes, but it will not file or pay them for you. As the merchant, you're responsible for registering in each state where required and sending the collected Shopify state sales tax to the state authorities by their deadlines. Shopify provides some tools and liability insights to help, but it doesn't submit filings on your behalf.

How can I get a Shopify taxes by state report from Mipler?

In Mipler, open the Tax per State report and click Export. Download the report as a CSV or Excel file. The exported file will list all the Shopify taxes by state you collected for the period you selected, so you can use it when filing your returns.

Do I need an app like Mipler for state tax reports?

Shopify's basic reporting may not break down taxes by state in detail. A third-party app like Mipler is helpful for generating a comprehensive Shopify taxes by state report covering all your Shopify state taxes. Mipler provides the customization and automation that built-in Shopify reports lack, making multi-state tax compliance much easier.