Worldwide market expansion exists for Shopify store owners who need to resolve particular tax compliance difficulties. A successful expansion in the global market depends on their ability to control VAT (Value Added Tax) and GST (Goods and Services Tax) and sales tax regulations between different regions to protect profits while preventing compliance failures.

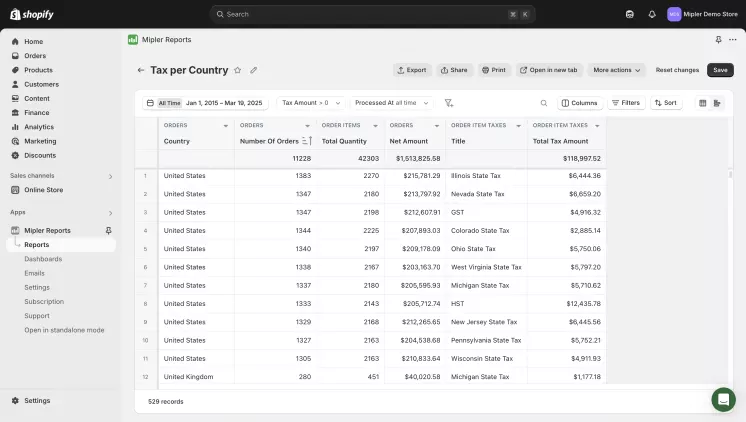

Shopify Taxes per Country Report presents easily understandable tax requirements for every nation. The tool enables businesses to improve their tax reporting because it helps them ensure submission transparency with legal compliance through accurate financial data.

Why the Shopify Tax per Country Report is Important

- Each sales tax system in the world displays its own unique financial rules that require specific rules from businesses. VAT in the EU, GST in Australia, and sales tax in the US, they all have different tax systems which you need to take care of.

- Every business needs to regulate tax nexus through their location or their revenue streams in separate jurisdictions as part of their tax registration and payment duties.

- Many countries apply their tax systems to collect taxes from customers based on their location rather than distance from the seller, which requires exact tax evaluation.

- The lack of precise tracking can lead to legal fines and legal problems which can result in false tax charges which negatively affect business success.

Benefits of the Shopify Tax per Country Report

A structured tax report enables four key advantages to become achievable:

- The right system produces correct tax reports, which avoids processing errors and fulfills all reporting requirements.

- The financial forecasting system together with planning mechanisms can focus on tax obligations for different regions to assist businesses during planning stages.

- The platform enables merchants to change prices and operations when assessing tax effects.

- To avoid legal trouble, businesses must reach specific tax requirements which enable them to participate in collection and remittance obligations.

The Sample Tax Rate Per Country Breakdown table offers primary value through its comprehensive breakdown of sales operations with local tax regulations, which help create effective Shopify Tax Reports. Companies analyze this data to locate tax-prone areas before developing tax management procedures by comparing their revenue data to taxation rates.

How the Shopify Tax per Country Report Helps You

- Monitor VAT and GST Thresholds

- Every business operating within the European Union must obtain VAT registration when reaching €10,000 of revenue in any EU member country.

- The report serves to monitor the €10,000 limit, so businesses can stay in compliance on time.

- Enhancing Customer Experience

- Customers can see accurate tax calculations as they check out because the system provides full transparency.

- Organizations obtain important data to select Delivered Duty Paid (DDP) shipping programs.

- Easier Tax Filings and Reporting

- Keeping your Tax record becomes simpler using a program which merges every data point into a single visible area.

- The elimination of manual calculations improves business efficiency and reduces mistakes that ultimately saves time.

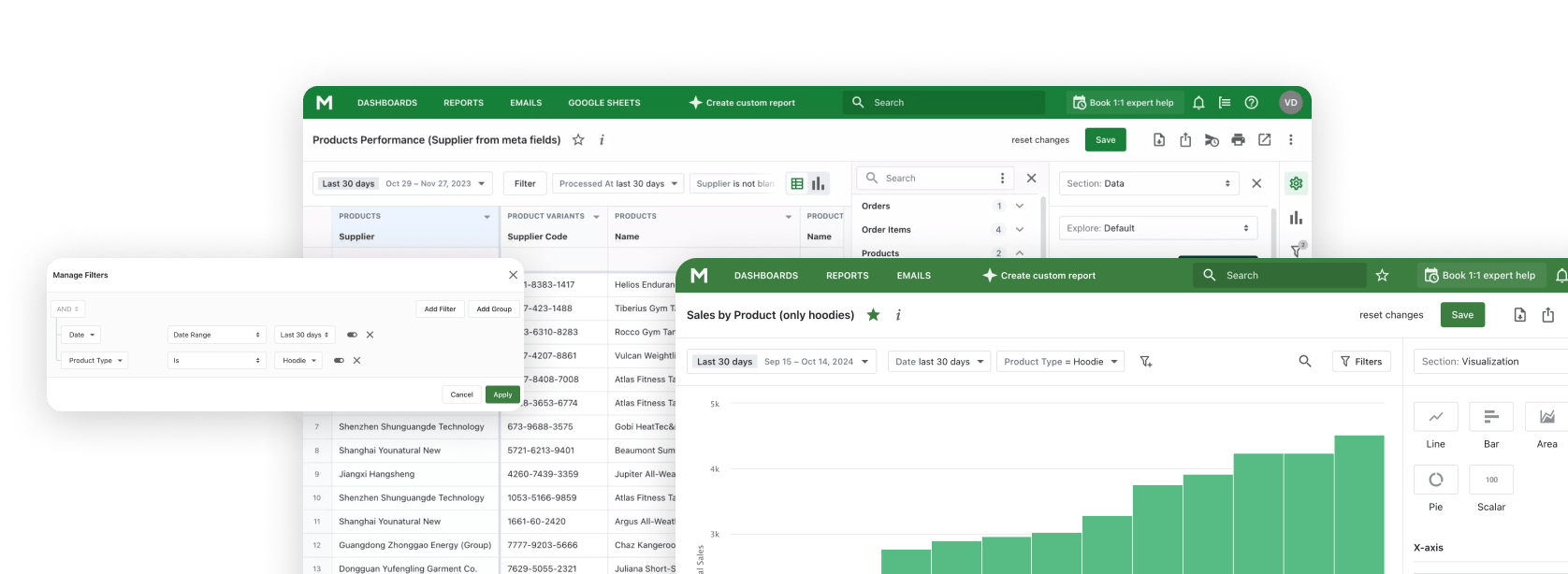

Create a Shopify Tax per Country Report with Mipler

Mipler provides Shopify users with enhanced tax reporting features that upgrade standard capabilities presented in Shopify Reports.

Steps to generate a Report:

- Open Mipler Reports in Shopify.

- Select ‘Tax per Country Report'

- Apply filters (e.g., date range, country-specific reports).

- Download in CSV, Excel, PDF, or Google Sheets format.

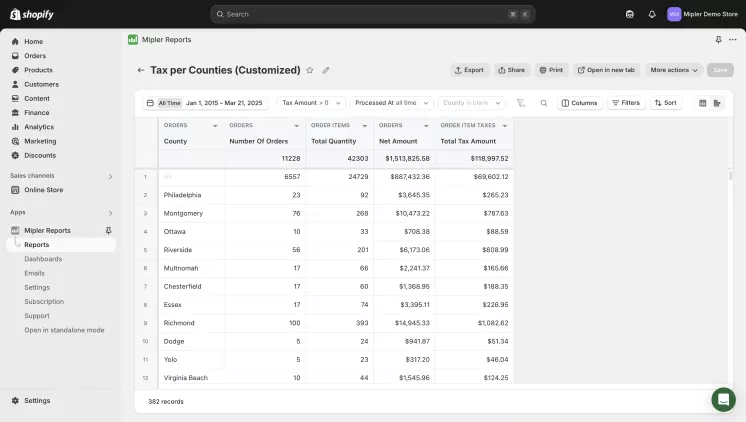

Customizable Features

- Date range selection

- Column filtering for focused insights

- Country-wise breakdown for targeted compliance

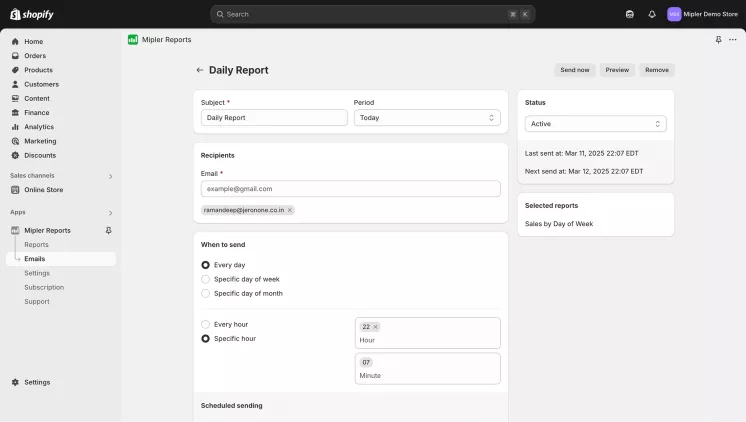

Automate Your Shopify Tax per Country Report

The automated tax report generation system provides businesses with precision without any manual work. Users can establish routine Shopify Sales Reports through Mipler to receive automated tax summaries straight to their email accounts on any chosen timeframe. Automatic systems help businesses monitor their tax responsibilities in real-time, which minimizes the chance of important compliance deadline failures.

Important

The tax reports available through Shopify offer critical business understanding, but after some time it becomes not enough for growing stores. Consultations with experts help ensure compliance because regulations often evolve.

The free tax features of Shopify are available for businesses earning fewer than $100,000 globally. Beyond this, additional fees will apply to your store. Knowing these costs will assist in selecting between Shopify tax tools and independent solutions such as Mipler.

Companies need to include import duties and customs fees as separate charges, since they differ from both sales tax and shipping costs when developing pricing methods.

FAQ

What does the Shopify Tax per Country Report include?

Every country's taxation requirements are presented in detail, with documentation of total sales revenue and both the collected and quantified amounts of tax and order numbers.

How often should I review my tax report?

At least monthly or quarterly, especially for tracking VAT registration thresholds.

Does the report cover import duties?

The system concentrates its analysis on three taxes, which include VAT and GST and sales tax.

Can I customize reports in Mipler?

Users can both filter data and establish date boundaries and personalize column attributes based on their individual business requirements through the application.