Each taxable sale means you've collected money that must be passed to the government, so keeping track of those taxes is crucial. That's where the Shopify Collecting Sales Tax Report comes in. It's a report that shows all the sales taxes you've collected over a month. If you're collecting sales tax on Shopify, this report is invaluable at tax time.

Why the Shopify Tax Collected Report is important

Whenever your Shopify store makes a taxable sale, you are responsible for collecting sales tax in Shopify and eventually remitting it to the government. The Shopify Tax Collected Report compiles all those collected tax amounts in one place. Without it, you'd be manually tallying taxes from orders – a tedious, error-prone task. Using this report ensures compliance with tax laws. If you ever need to prove the taxes you've collected, this report provides a reliable paper trail.

Benefits of the Shopify Tax Collected Report

The Tax Collected (Monthly) report brings multiple advantageous features to users:

- Stay compliant across regions: This report provides exact taxes collected on Shopify for each location when your store sells products to multiple states or countries.

- Time-saving summaries: Finding information becomes simple because one does not need to examine individual orders. The report generates a complete monthly summary, which helps you save time during tax reporting.

- Reduce errors and stress: The automatic summary feature reduces errors resulting from manual calculations of tax amounts.

How the Shopify Tax Collected Report Helps You

This report provides clarity about collecting sales tax in Shopify from individual tax jurisdictions during monthly periods. You can obtain totals for each area region from this report during tax time to put in your returns. Shopify users no longer need to rush order inspection during tax time. Checking this report helps verify that Shopify maintains proper taxing procedures.

Create a Shopify Tax Collected Report with Mipler

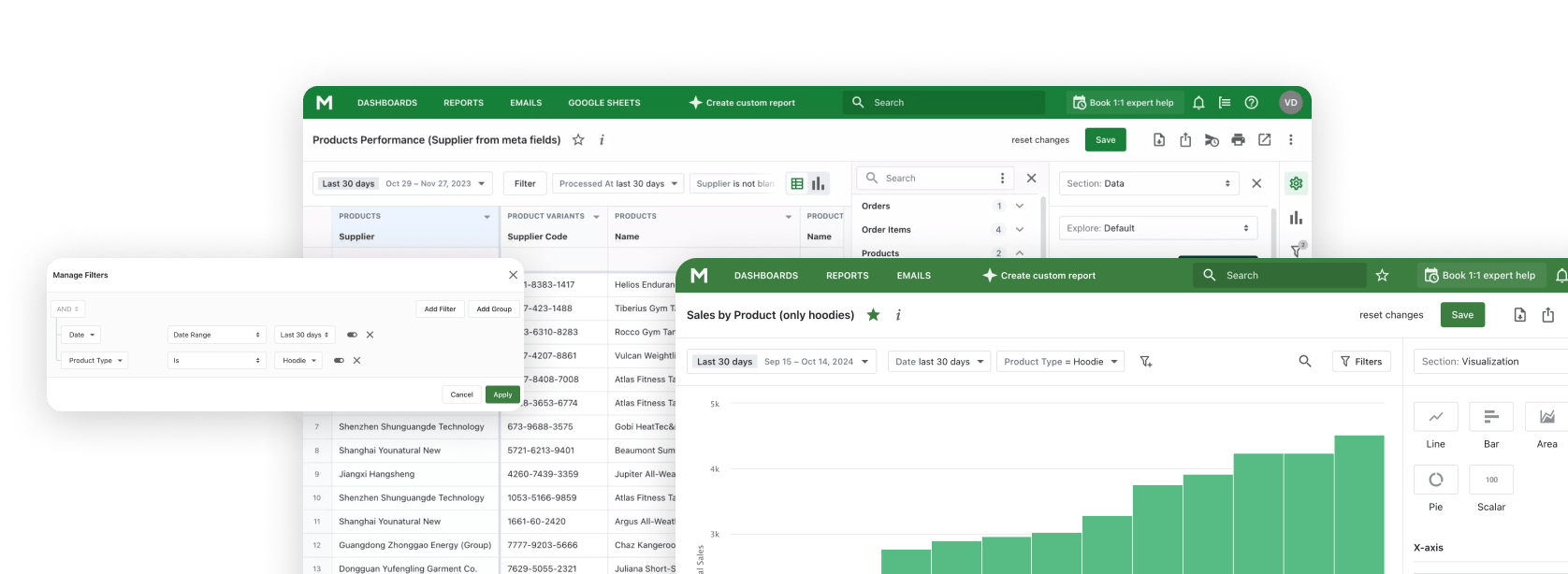

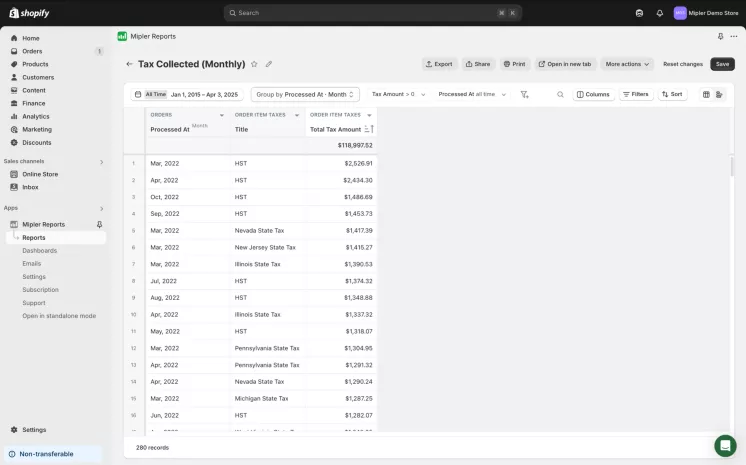

How can you generate this report easily? Shopify's built-in reporting (available on certain plans) might give basic tax info, but a tool like Mipler makes it much simpler. Mipler is a reporting app that provides ready-made Shopify Tax Reports, including a dedicated Tax Collected (Monthly) report. To create it with Mipler, just follow these steps:

- Open Mipler in your Shopify admin. Find the Tax Collected (Monthly) report in the app's library of Shopify Reports.

- Select the date range you want to review (e.g., Last month) and apply any country or state filters.

- View and export your report. Then, export the report (CSV, Excel, PDF, etc.) to save or share it.

Automate Your Shopify Tax Collected Report to Optimize Your Store

Mipler provides an excellent advantage with its automated report scheduling feature. Mipler allows users to automate tax report generation so you receive results automatically by email. Enabling automated Shopify tax reports lets you maintain the most current tax data without any effort. You can program the report system to send its data to your inbox each first day of the month, including the previous month's totals. The scheduled reports will free up your time so you can handle different business tasks.

Important

Never overlook the taxes your store collects. The Shopify Tax Collected Report (Monthly) is an essential tool to keep track of every tax dollar you've collected. By regularly reviewing this report, you ensure that Shopify is collecting sales tax correctly and that you're prepared to remit those amounts to the authorities. Mipler's Shopify Sales Reports also show the tax on each order, giving more detail to complement your monthly tax report.

FAQ

What is the Shopify Tax Collected Report?

It's a summary of all collecting sales tax in Shopify for your store in a given period (usually by month). The report breaks down the total tax by jurisdiction (state, county, country) so you know how much you owe to each.

Does Shopify automatically remit the sales tax it collects?

Shopify can calculate and collect sales taxes through the checkout system only when you configure tax settings across all regions. Shopify collects sales tax from customers before purchase, yet it does not manage tax payments to public authorities. You need to file tax returns while you are responsible for transferring the collected taxes to government authorities. Shopify controls tax collection at checkout, but you need to perform all reporting duties and remit payments to tax agencies.

How can I be sure I'm correctly collecting taxes on Shopify?

Review your Shopify Taxes and Duties configuration. Set up every tax region (state, province, country) that requires taxation and mark your products as taxable to enable Shopify to collect taxes. Shopify applies the correct tax rates to the checkout process. Be aware of latest tax law transformations, especially the updates on internet sales tax rules. Your Tax Collected Report enables you to identify which transactions fail during Shopify collecting tax that should be collected.

What's the easiest way to get a monthly sales tax report?

Use a reporting app. Shopify's standard reports can show sales tax info, but an app like Mipler gives you a ready-made Shopify report of sales tax collected each month with minimal effort. Just open the Tax Collected (Monthly) report in the app to see all your data, or schedule it to email you automatically. Otherwise, you would need to export Shopify data and manually sum up taxes each month, which is time-consuming.