Every Shopify store owner has faced this question at some point:

Which collection truly drives profit

and which one just takes up shelf space?

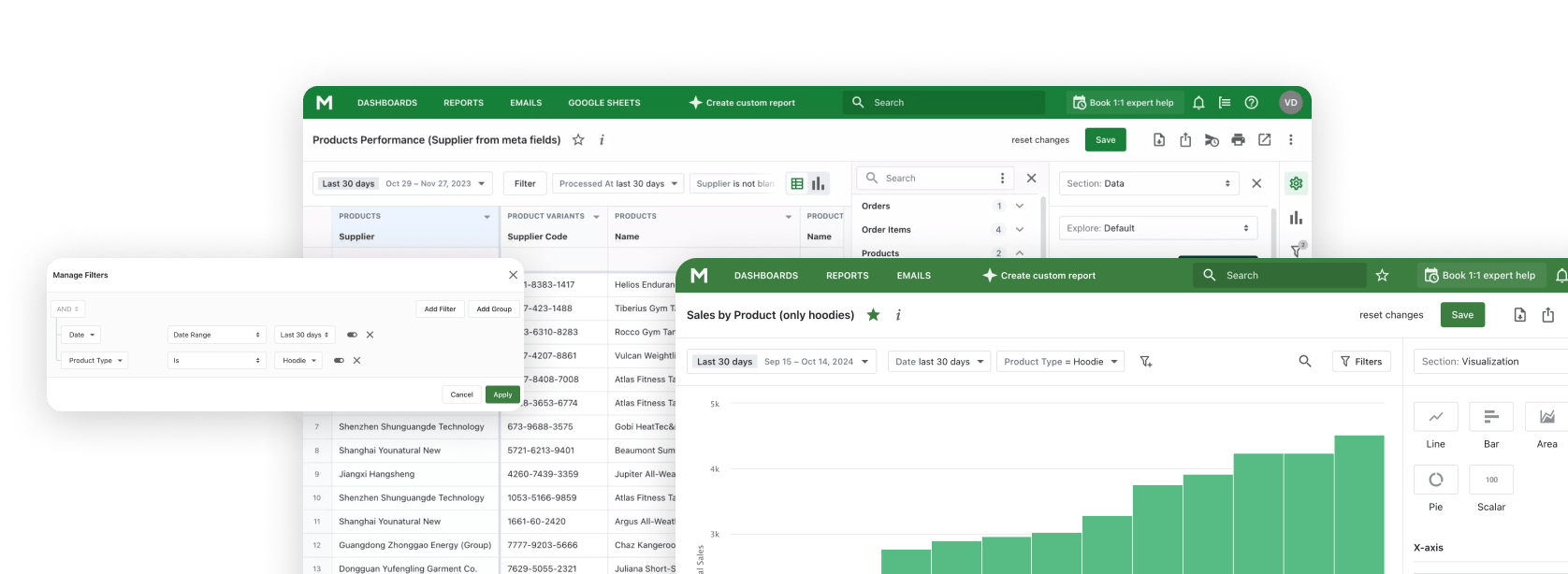

Shopify's built-in analytics can't give a clear answer, since it lacks a proper sales-by-collection summary. That's where Mipler's Shopify Reports report steps in, the feature many merchants didn't realize they were missing.

In just a few clicks, you can see which collections bring in most of your revenue, where your store is losing momentum, and how category performance shifts over time. Not just numbers, but a clear story of your business.

Shopify Sales by Collection Report Made Simple and Accurate

Mipler's Sales by Collection report comes pre-built and precise. It lists each collection with its key metrics (orders, quantities, sales, etc.). Standard Shopify lacks any built-in collection summary, so this report fills the gap. For example, one store's data shows Tops $8,108.59 (57 orders) and Outwear $9,283.50 (47 orders), instantly highlighting top-performing categories.

How Mipler Solves the Problem of Reporting on Sales by Collection

- Outerwear brand:

In July, a small clothing store saw that 42% of sales came from jackets, while accessories were just 5%.

They launched a "Buy a jacket, get 30% off accessories" promo.

By August, accessory sales had doubled, and average order value rose 12%. - Furniture retailer:

The report showed 50% of Q2 sales came from furniture, with bedding trailing at 16%.

The owner cut bedding orders and reinvested in trending sofas — saving warehouse costs and improving turnover. - Cosmetics brand:

Skincare accounted for 55% of total sales, fragrances just 4%.

They redirected 70% of ad spend to skincare, boosting ROI by 25%. - Electronics store:

Headphones grew to 18% of total sales, surpassing tablets at 12%.

After featuring headphones on the homepage, upsell conversions rose 15%. - Lifestyle shop:

Reports showed 30% of repeat customers bought from yoga collections.

They launched a loyalty program for yoga fans — improving retention.

For even more detailed breakdowns, Mipler also provides a Shopify Sales by Variant report, helping merchants track performance at the SKU level.

Important

Shopify's standard analytics cannot produce a by-collection summary. Mipler's report is the easiest way to get these insights.

Benefits of the Sales by Collection with Mipler

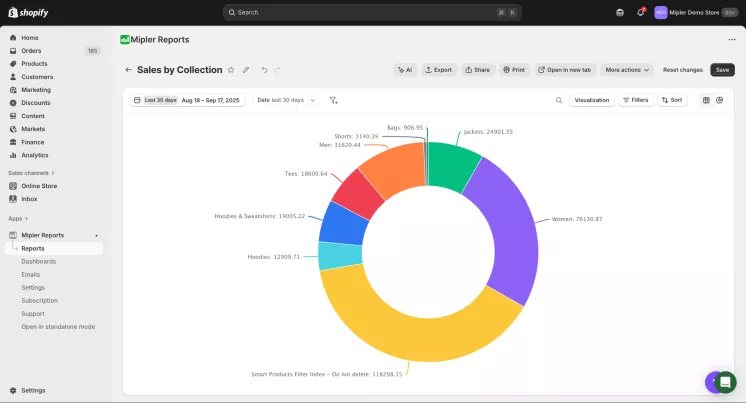

With Mipler's Shopify sales by collection reports, you don't just get raw numbers, you gain actionable insights that help you refine strategy, improve operations, and boost profits and here's why you should choose this report:

- Identify top collections: See at a glance which categories drive the most revenue.

- Spot weak collections: Find categories with low sales and target them for promotion or improvement.

- Optimize inventory: Stock more of what sells and reduce excess of slow-moving collections.

- Increase profitability: Use insights (e.g., bundling or discounting unpopular items with bestsellers) to boost overall sales.

Shopify Sales by Collection Reports – What's Available with Mipler

Mipler offers a pre-built Sales by Collection report template, one of more than 100 report templates. The default view displays monthly totals, however, you can change date filters, add additional fields (e.g., Order Name or CLV), and sort the data. As an example, a year view with sorting by total sales immediately identifies your best collections. Also, it is possible to schedule this report or export it to Google Sheets to maintain data synchronization.

FAQ

What is the Shopify Sales by Collection report?

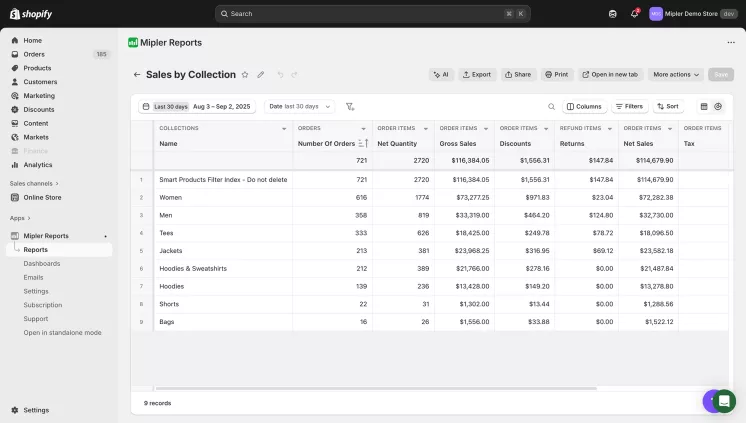

It's a detailed report that groups your sales by product collection, showing how each category contributes to total revenue.

Which metrics does it include?

You'll see key data such as the number of orders, net quantity sold, gross sales, discounts, refunds, taxes, and net sales for every collection.

How can this report help store owners?

It quickly reveals your best- and worst-performing collections, helping you focus marketing efforts on what sells best and take action to improve or promote weaker categories.

How can I access this report in Mipler?

You can find it in the Shopify Sales Reports section or directly in the Mipler Report Library:

- Open Sales by Collection under the Reports section.

- Click Export to download it as a CSV or Excel file.

You can also schedule automatic reports or sync them with Google Sheets for real-time updates.