This is an important question that worries all business owners - how to formalize the company's activities properly and not have problems with taxes and the law in the future. Each country has its taxation features, so first, you need to understand how it works in your country.

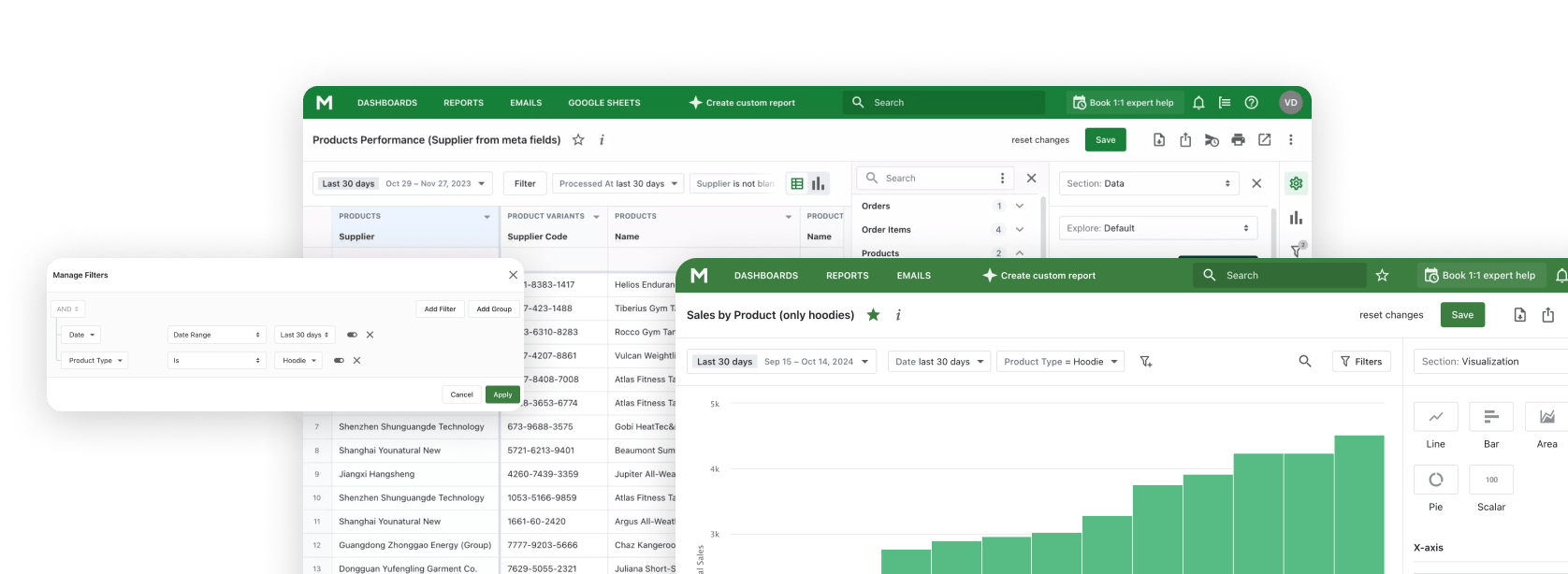

An equally important question that owners who work with the Shopify platform need to solve is what official documents and licenses are required to cooperate with the platform. Shopify Reports can provide valuable insights into your business performance, helping you stay compliant and make informed decisions regarding legal and financial matters.

In this article, we'll discuss whether it's necessary to have a tax ID, EIN, LLC, to get started with Shopify and what it is at all.

What is a Shopify tax ID?

Tax ID stands for tax identification number. This special number is assigned to everyone who has to pay taxes. This number can be used to track a person's tax payment history. Of course, each country has its characteristics, and before starting commercial activities, you should consult with specialists to avoid future problems. However, tax ID is something that exists in every country.

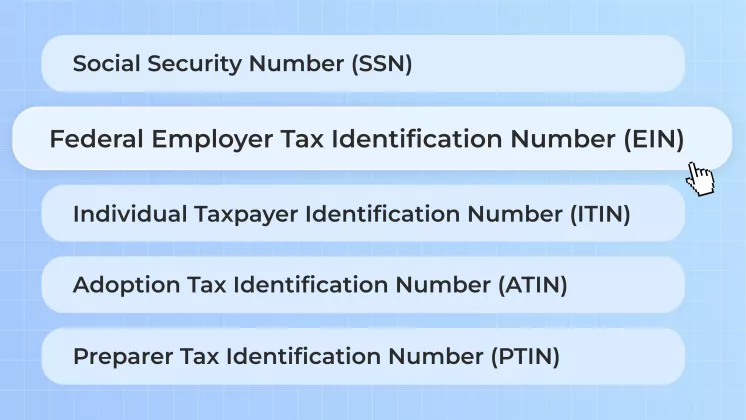

What are the types of tax numbers?

There are a lot of different tax numbers that US citizens possess. However, while some of them can be used to sell goods through Shopify, others don't. Let's look at them:

-

Social Security number (SSN)

Everyone residing in the USA is assigned an SSN, which serves multiple uses, from personal identification to tax monitoring, offering convenience.

-

Individual taxpayer identification number (ITIN)

Some people, though, cannot obtain an SSN, for example, non-permanent country residents, like immigrants. They can receive an ITIN and use it instead to deal with taxes.

-

Federal employer tax identification number (EIN)

This type of tax ID will be described below.

-

Adoption tax identification number (ATIN)

The ATIN is a rare kind of temporary tax identification. It can only be received by a parent who recently adopted a child who can't have an SSN yet. This document will no longer be needed when a child gets their SSN.

-

Preparer tax identification number (PTIN)

The PTINs are issued to people who help different businesses with filing a federal tax return.

PTIN, so as ATIN, is not intended to be used to pay taxes for commercial activities. Therefore, if you need to pay sales taxes on Shopify, you must have an EIN, SSN or ITIN.

What is an EIN for Shopify?

If you have a business or enterprise SSN or ITIN will not be considered legitimate for tax purposes. That is why there is a special kind of tax ID - employer tax identification number(EIN). While SSNs and similar are issued to individuals, only businesses, regardless of size, may receive and use an EIN. Applying for an EIN is crucial if your enterprise has hired employees. This tax ID is necessary to pay payroll taxes, which is mandatory for commerce.

Do you need a tax ID to sell on Shopify?

Every kind of business requires a tax ID number, although there are a few exceptions. Conducting business is not possible without an SSN, ITIN, or EIN.

In general, you do not need any of the tax IDs to work with the platform. Nonetheless, without a tax ID, you can't pay taxes or utilize certain benefits accessible to those holding an ITIN or EIN.

Shopify does not require any tax ID to run your business. Such a feature allows store owners to test the developed business plan, correct deficiencies in store management, adjust deliveries and interact with customers. If everything is successful, the owner will issue the type of tax ID he needs.

Do I need an EIN for Shopify?

The answer to this question depends on whether you have employees or not. If you are self-employed, you don't need EIN because you do business for SSN or ITIN. But when you have workers, and you work as one organization, having an EIN will establish the fact that the organization is legally established. Having an EIN not only provides advantages in doing business but also increases the trust of your customers in the organization.

One specific circumstance mandates having an EIN: owning an LLC. In this case, the company must have an EIN to register its store and manage the taxes due.

Explore related reports

What are the benefits of Shopify Sales Tax ID and EIN?

Firstly, possessing one of these identification numbers streamlines your business's accounting processes. You can open a bank account specifically for the store and separate the store's income from your personal funds. Accordingly, you will not need to have a cash register, and it will simplify the maintenance of tax returns because all transactions will go through the bank and be recorded there. And Shopify will help track the amount of tax that needs to be paid.

Secondly, your customers will trust you more because you have official confirmation that you are doing legitimate business.

Thirdly, you will have the opportunity to participate in various government support programs. For example, during COVID-19, the government provided soft loans and support to struggling business owners. You must have at least one of the considered tax IDs to claim assistance.

Fourth, Shopify helps business owners track the taxes they need to pay on their platform. And you will not need to calculate them yourself and add them to the cost of products. Shopify can be set up to calculate taxes due in your country and state automatically. The steps to help set this up are detailed here. Shopify Tax Reports provide a clear breakdown of collected and owed taxes, ensuring compliance and simplifying financial management.

How do I get a sales tax ID for Shopify?

The process of getting tax IDs is not difficult, but first you should consult with a specialist which can help you find needed forms to fill out or search the Internet for a form that will help you get the desired ID.

To obtain an EIN or ITIN, you can apply through the IRS website if you're operating in the US or through your respective country's official tax website. A small addendum, the forms you need to fill out to get an EIN and ITIN are different, so you need to find the right form first.

To get an SSN, you can apply both online at the SSA website and in person at a local Social Security office. However, you can get a number only if you are physically present in the USA and have all the necessary documents.

Fortunately, all you need to list your existing tax IDs to Shopify is access to your account on the platform. It's just a matter of going to the Settings menu, selecting the tab "Taxes and duties", and setting up your profile as instructed here.

How does a Business License (LLC) affect this?

To protect their wealth from possible unforeseen situations in business, owners often draw up a special form of ownership that separates the business into a legal entity. It names a limited liability company (LLC). This business license is well known for the flexibility it provides business owners. Shopify doesn't require LLC because not all business owners benefit from this form of ownership.

However, it should be considered that when the store is registered as an LLC, it is necessary to issue an EIN. In addition, you should know that in several situations, you need to have an LLC to sell in Shopify store:

- You offer law-regulated products (for example, drugs, firearms, also goods that can cause fire or injure children)

- You utilize the Shopify payment gateway.

- Selling products that require medical clearances.

In other cases, you create a business license of your choice.