In the realm of online commerce, ensuring a diverse array of payment options is paramount for the prosperity of any digital venture. A sought-after functionality for merchants is the capacity to bifurcate payments or embrace partial payments within their Shopify storefronts. This empowers customers to segment the total purchase amount into numerous transactions, providing an elevated level of control over the efficient administration of their financial assets.

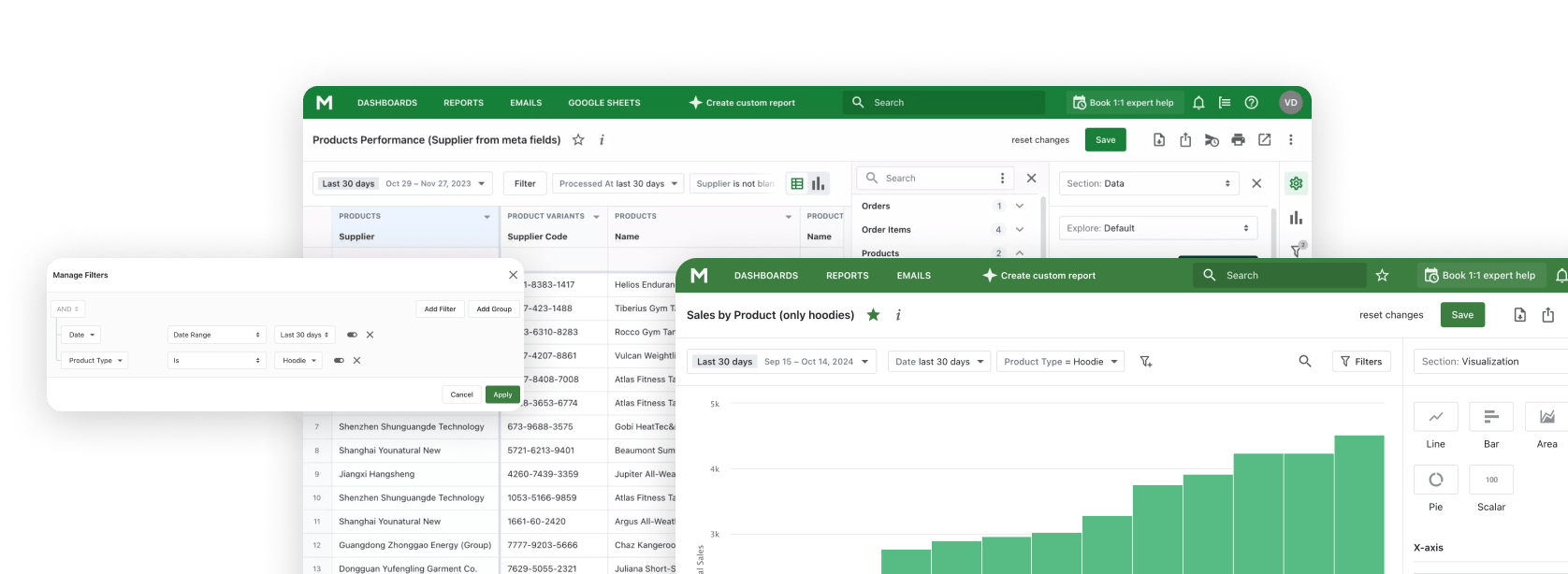

Shopify Report for Payment Method is an essential tool for merchants, offering insights into customer preferences and helping optimize the payment options available in their Shopify store.

The concept of Buy Now Pay Later (BNPL) has proven effective in boosting conversions and reducing instances of shopping cart abandonment. While these notions might seem intricate at first glance, let's delve deeper into their intricacies.

The dedicated Mipler team has meticulously gathered vital data to address fundamental questions: What constitutes split payments? Is the division of payments supported in Shopify? What defines partial compensation, and how is it embraced? Additionally, an exploration of the advantages and disadvantages of partial compensation will be conducted.

Commencing with the inquiry: What characterizes split compensation?

What precisely are split payments?

Traditionally, split payments entail segmenting the total amount owed into two or more portions, each independently paid. This can involve using diverse payment methods, such as combining a card with PayPal or distributing the payment among multiple contributors.

For example, a customer may purchase products totaling $200 and pay by cash, credit, or debit card, combining multiple transfer methods. Similarly, when buying a group gift through Shopify, each person can contribute their share directly, exemplifying the concept of split compensation.

According to Shopify's official documentation, split payments allow customers to split their payments into smaller parts. If the customer cannot fulfill the order, the payment can be divided into several segments.

In online purchases, split payments refer to the distribution of payments across multiple invoices without involving different payment methods or different payers.

Explore related reports

Is it possible to split payments in Shopify?

Although split payments can be accepted in Shopify POS, this feature is not directly supported online. Unfortunately, Shopify does not support split payments for online stores.

Split Payments on Shopify is an end-to-end compensation solution for physical Shopify stores.

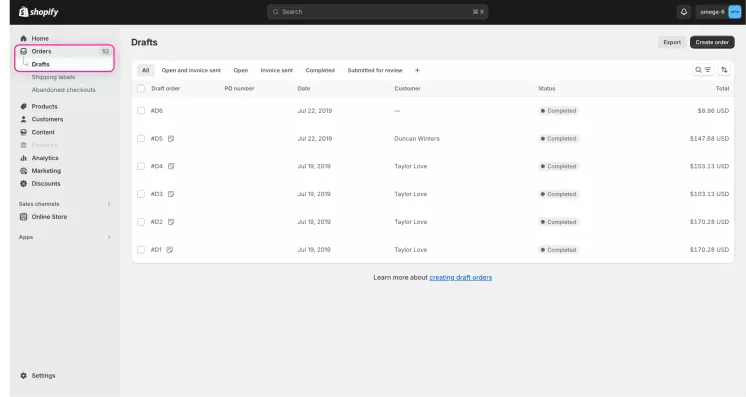

Although Split Payments is a universal solution for physical Shopify stores, this feature is unavailable when creating drafts or manual online orders. Therefore, traders must explore workarounds and use additional tools to achieve the desired distributed compensation setup.

To facilitate split rewards online, it is recommended that you create incremental project orders.

To monitor the progress of the compensation, sellers can refer to the original order details (number and amount) in the new draft order. Alternatively, they may consider purchasing a program designed to address this issue. Unlike merchants with a Shopify POS, split payments can be processed seamlessly in a brick-and-mortar store.

Shopify POS is a point-of-sale software that allows merchants to sell goods in person, whether in brick-and-mortar stores or marketplaces. It easily syncs with Shopify to track orders and inventory, allowing sellers to manage their store's orders directly through the app.

What is partial compensation?

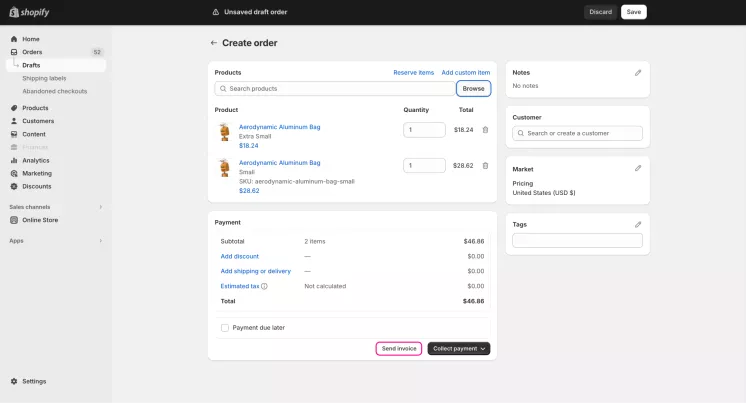

Shopify's partial payments feature allows sellers to collect and document multiple payments for a single order. It provides various payment options, including credit cards or manual methods such as bank deposits.

This feature allows sellers to gradually collect payments for orders by changing the order status to "Partially Paid." Essentially, this refers to the processing of payouts in installments.

How do you accept partial compensation?

To receive partial Payment on Shopify, merchants can use the split payment feature in the Shopify POS app. This feature allows you to collect multiple payouts for one order.

Partial Payment will enable sellers to collect and record various payments for an order by updating the order status to Partially Paid.

To accept a partial payment on Shopify, sellers can follow these steps

Open the payment dialog and tap split Payment> enter the desired amount > choose a payment method > tap the mark as partially paid. Sellers can receive partial reimbursement through various methods, including credit cards from the vault (for B2B customers), new credit cards, or manual reimbursements such as bank deposits. When registering an installment payment, merchants can decide whether it will be a fixed amount or interest based. After registration of partial compensation, the order status changes to "Partially paid," which the customer reflects in his account.

To receive another refund for a partially paid order, sellers can

- Click on the order and select Get Refund.

- Enter the desired customer compensation amount.

- Specify the method of compensation and complete the transaction.

- Click Done.

- Finally, to complete the transaction, if this is a final settlement, merchants can select "Done." They can pay in installments for

- Mark if there is an outstanding balance.

- Click "Done" to complete the process.

Advantages and Disadvantages of Partial Compensation

Advantages

-

Convenience for the customer:

Customers who do not have the total amount or do not want to exceed the daily spending limit on the card can use the option of partial compensation. -

Fewer abandoned carts:

The "buy now, pay later" principle positively affects the store's conversion rate. Even expensive goods are more affordable in installments than when a one-time transfer is required. -

Good customer relationship:

Providing customers with convenient purchasing options can create a positive experience with the service. -

Increased brand loyalty:

Satisfied customers are likelier to return and recommend the store to others.

Disadvantages

-

Long-term debt collection:

The debt repayment process can take some time. -

Administrative Burden:

Managing and tracking partial compensation can be administratively burdensome, requiring constant monitoring of transfer processes. -

Risk of late transfer:

Ccompensations may be delayed if the payer does not have the necessary amount on the card on the day of receipt.

Conclusions

The success of e-commerce hinges on providing customers with flexible payment options, including the ability to split payments or accept partial compensation in Shopify stores.

The effectiveness of the Buy Now Pay Later (BNPL) concept is evident in boosting conversions and reducing cart abandonment.

When it comes to implementing split payments, the difficulty lies in achieving a smooth process within the Shopify platform.

Shopify Reports play a crucial role in helping merchants analyze customer behavior and identify trends that can inform decisions about implementing payment flexibility features.

For online merchants, there's a necessity to delve into alternative methods and utilize additional tools, underscoring the demand for inventive solutions.

To sum up, the ever-evolving e-commerce scene necessitates a strategic integration of elements like split payments and partial compensation. This integration plays a pivotal role in crafting a frictionless customer experience, ultimately influencing the overall triumph of online enterprises operating on the Shopify platform.