A question for online store owners: who among you would like to know the future of your store? We guess that everyone who heard this question.

Customer Lifetime Value is a metric that accurately determines the long-term outlook of your business.

In this article, we'll explore the hidden but invaluable metric known as LTV or CLV. You'll gain insights into what LTV is, how to calculate it, the factors that influence its results, and why it plays a crucial role in e-commerce.

Plus, as a bonus, we'll walk you through a step-by-step Google Sheets tutorial on how to compute this metric effectively.

What is Shopify LTV?

LTV definition

Customer lifetime value (LTV or CLV) is an estimate of the total amount a customer spends on products or services during the entire period of cooperation with your store.

LTV lets you see how average order value, purchase frequency, and customer lifetime affect your store's performance. Therefore we can see how your customers react to changes in pricing policy and marketing strategy over a long period of time.

In other words, how long your customers want to buy your product shows how efficiently all areas of your business work. And knowing exactly how much time and money your customers are ready to invest, you can predict the future of your store.

LTV is how much one customer will bring for the entire period of cooperation with the store. By multiplying by the number of your customers, you can calculate how much profit you will have.

If you limit yourself to a certain period, for example, a month, then you can calculate what income you plan to have in the next month.

LTV formula

As mentioned, LTV is made up of many other metrics. It is best to see them by studying the calculation formula. It also makes it possible to draw conclusions about how each of them affects the final result.

Let's start, of course, with the LTV formula and then explain each component separately:

CLV = ACV (Average Customer Value) * ACL (Average Customer Lifespan)

Essentially, LTV is the average amount of money that each of your customers brings in, multiplied by the average time the customer spends with your store. Moreover, this is not the average time the client spends on the site. This is the time that passes from the first purchase in your store to the last.

Formula of ACV:

ACV = AOV (Average Order Value) * APF (Average Purchase Frequency)

Where:

APF = Total Orders / Total Customers

AOV = Total Sales / Total Orders

ACV - how much, on average, one customer spends in your store.

APF - how many orders, on average, are placed by one customer.

AOV - average order value.

Let's consider what the ACL metric consists of:

ACL = (sum customers" lifespans) / Total Customers

That is, how long, on average, one customer uses the services of the store.

Example of calculation LTV

Let's take an online store that sells household goods as an example.

LTV is calculated over a period of time.

Therefore, in this example, we propose to consider a period of five years.

- Customers' Lifespan = 3 years or 36 months

- Total Customers = 12 000

- Total Orders = 250 000

- Total Sales = $22 000 000

So now we can calculate sum of lifespans as:

Sum Customers" lifespans = 36 months * 12 000 = 432 000

Before calculating LTV for your store, decide whether you will use months or years. We will take all values in months.

Average Customer Lifespan (ACL):

432 000 / 12 000 = 36 months

Each customer buys goods in the store for about three years.

Average Purchase Frequency (APF):

Total Orders / Total Customers = 250 000 / 12 000 = 20.833

Each client of the store made about 21 purchases over 5 years.

Average Order Value (AOV):

Total Sales / Total Orders = 22 000 000 / 250 000 = $88

Each purchase was worth $88 on average.

Average Customer Value (ACV):

AOV * APF = $88 * 21 = $1 848

$1,848 was brought by 1 customer for all the years of cooperation with the store.

And now a very interesting nuance in the calculations. Since we take values only for a certain period of time. When we calculate the Average Purchase Frequency, we immediately take into account the ACL. This nuance means that there is no need to multiply ACV by ACL again. In accordance:

CLV = ACV = $1 848

So, you can expect that each new customer will bring you $1,848 in revenue over three years.

How to influence your LTV?

Based on the CLV formula we described earlier, you can increase your bottom line in four ways:

- Increase Average Customer Value (ACV).

- Increase the average time your customers spend in the store (ACL).

- Increase both at the same time.

- Just increase the number of customers who will buy something in your store at least once.

The first two ways will be the most profitable for your store. The close cooperation between your store and the customer for a long time means that you have become a brand that can be trusted. This is what will get you new visitors, without any additional cost of attraction.

So, let's consider what affects the ACV and ACL

metrics.

Let's start from ACV - it consists of these two metrics:

APF = Total Orders / Total Customers AOV = Total Sales / Total Orders

These values help segment customers. By identifying the customer group you are interested in, you can determine the effectiveness of your marketing strategy. This will be seen by the fact that: the number of orders has increased. It is also possible to monitor how the change in the store's pricing policy affected the purchasing power of users and much more. The same can be done to estimate how much income each segment of your products brings you.

The second way to influence the results of the CLV metric is to increase the time during which the customer returns to buy the product again. This means that the ACL should increase. In this case, short-term marketing strategies do not work. You should focus your attention on the quality of your products and service.

Then users will want to come back and buy this product again. Or change your business model to one where customers will need to purchase some part of your product. For example, shaving nozzles or capsules for dishwashers.

You need to focus your attention on the quality of the product so that users will come back and buy this product again. Or change your business model to one where customers will need to purchase some part of your product. For example, shaving nozzles or capsules for dishwashers.

Also, if you want to apply the first tactic - to segment your products and customers, then during the ACL calculation, they must also be separated. To evaluate a single segment, you only need to use in the denominator those users who meet your requirements.

Why is LTV so important in Ecommerce?

There are several answers to this question. We will list all of them.

- The LTV is the main metric required to understand the maximum acquisition cost of a client. Subtract this value from the LTV cost of the marketing campaign and then you will see how effective your actions were in attracting customers. The only thing is that you cannot do this for your store's entire period of operation. Because your campaign funding and business performance will always change. It is always better to do this during the year and plan expenses for the next year based on the results of the calculations.

- This metric helps you monitor your customers' reaction to an advertising campaign or a change in pricing policy. According to the reaction, you will be able to adjust your actions. The reaction can be seen by whether the average check of your customers has increased. If you analyze over a long period of time, you can also see whether the duration of cooperation with your brand has increased. You should understand that all changes and innovations can be evaluated only in the long term.

- That is why LTV is very convenient - it evaluates the results over some time. Accordingly, you do not need to calculate each component separately. As soon as you see that the LTV has increased, some components have increased, which is already a very good result.

- The main benefit of LTV is predicting revenue. It allows business owners to generate revenue forecasts based on customer purchasing activity. Since the analysis takes place over some time, it is safe to say whether the company's profit will increase.

Knowing LTV allows business owners to generate revenue forecasts based on customer purchasing activity. Since the analysis takes place over some time, if there are no unpredictable influencing factors, it is safe to say whether the company's profit will increase.

How to calculate Shopify Customer Lifetime value?

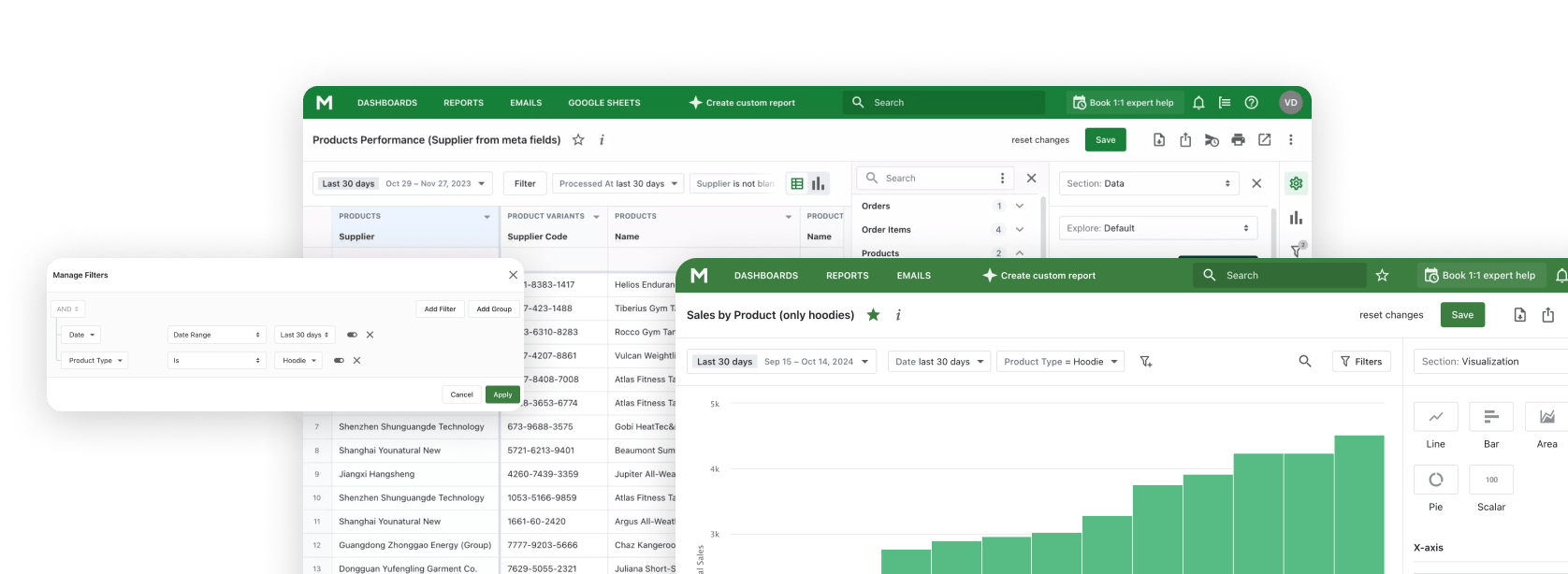

Unfortunately, Shopify does not have a ready to use report that calculates LTV for us. Therefore, so that you do not have to calculate it by hand, our expert analysts have developed our Shopify LTV Template by Mipler specifically for you.

What data do we require, and where can we find it?

The data you need to calculate Shopify LTV can be found in your store administration"s Analytics > Reports section.

The main Shopify reports that will give you all the information you need:

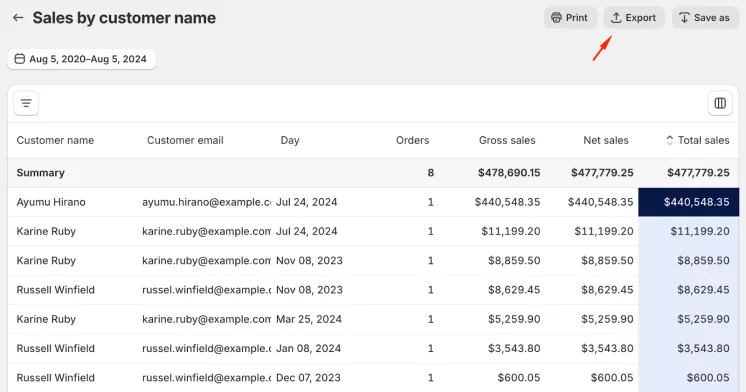

- Sales by Customer Name report

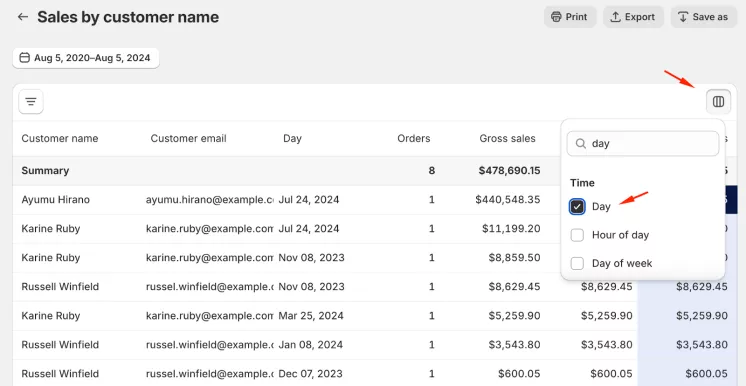

- Add "Day" column — it will show us date of order creation

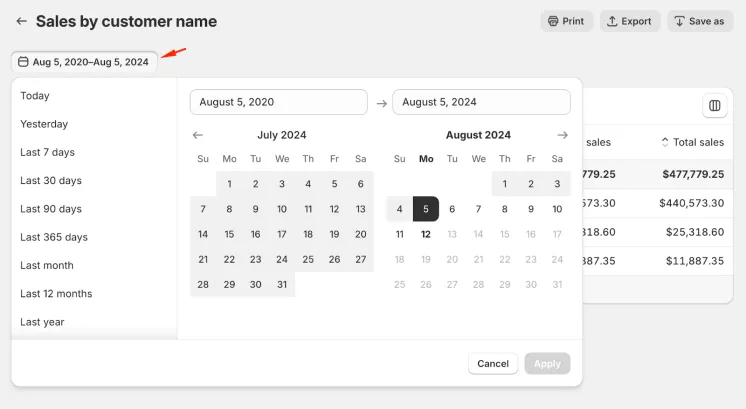

Step-by-Step Guide to calculate Shopify LTV in Google Sheets

In order to calculate LTV using the Mipler template, you need to follow these steps:

- Make a copy of Mipler LTV Template in Google Sheets:

- In the Shopify admin panel, go to Analytics > Reports

and open the "Sales by Customer Name" report: - Select the period for which you need to conduct the analysis,

for example, the last 4 years: - Add the "Day" column:

- Export the Report:

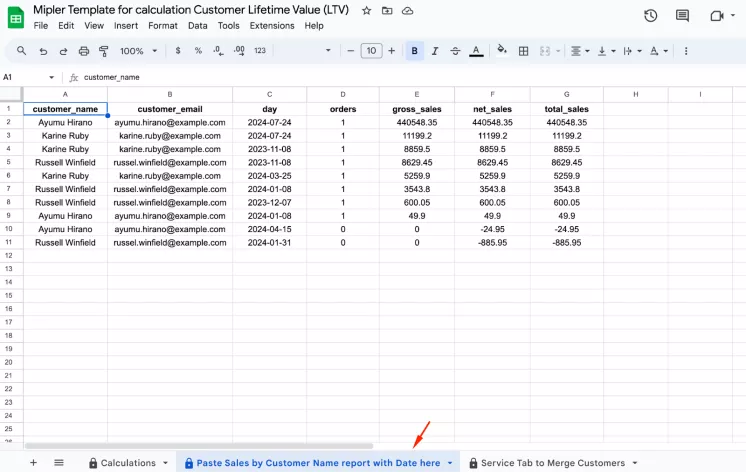

- Now insert the report that was obtained in the previous steps into our template on the second tab:

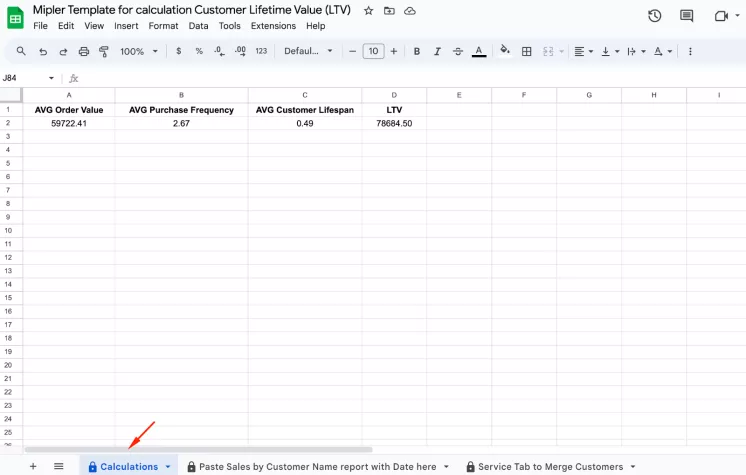

- Now you can go to the first tab to see the calculations for LTV and other metrics:

Conclusion

LTV is a way to see and understand how much your customers are willing to spend to cooperate with your store. By studying the components of this metric, you can understand what affects the income of your business.

It is very important how many times a customer returns to you, what is the average amount he is willing to spend on purchases and how long your customers will be with you (months, years).

Thanks to these results, you can forecast your future income and plan expenses for various activities. In this article, we not only showed how this metric works, but also provided a reliable tool to help you calculate all metrics - Google Sheet Template.