Shopify store owners face excessive stress regarding tax compliance because each county might feature a unique tax rate. The Shopify sales tax report by county provides complete data about revenue tax collection in local jurisdictions. We will explain the critical importance of this report and show Mipler as an app to generate Shopify Reports. Your sales tax per county data can save you from potential issues, and Sales tax tracking across every county will help you avoid any jurisdictional exclusions.

Why the Shopify Tax Per County Report is important

Local areas maintain independent tax rates from one another. If you do not track sales tax per county, it could lead to incorrect reporting of your tax obligations. For example, there's a base state tax and additional local surtaxes in Florida – a Florida sales tax per county breakdown shows each county's share. Similarly, taxes per county in Texas and all other counties. Through a Shopify sales tax report, you obtain precise totals for each area, which helps you maintain compliance with all local tax authorities. Your use of a Shopify sales tax report at the county level will help you maintain legal compliance.

Benefits of the Shopify Sales Tax Report by County

- Time savings: The report function automatically calculates sales taxes per county. No more manually sorting data for each county.

- Accuracy: The Shopify Tax Reports functionality from Mipler automatically prepares shopify sales tax Reports by county, verify that all regions have their taxes documented.

- Compliance: A final report will present an organized breakdown of all county tax amounts which you will use to file taxes (for example, when reporting California taxes per county). The system prepares sales tax per county, which simplifies both state reporting and audit procedures.

How the Shopify County Tax Report Helps You

This Shopify sales tax report by county acts as a safety net, ensuring no local taxes are overlooked. With this report, you can be confident no county is missed. You get all of your sales tax per county info without any extra effort.

It serves as a backup system to detect all regional taxes. The Shopify sales tax report by county allows your business to maintain confidence that all counties have been included. You gain access to your sales tax per county without adding additional work.

Create a Shopify Tax Per County Report with Mipler

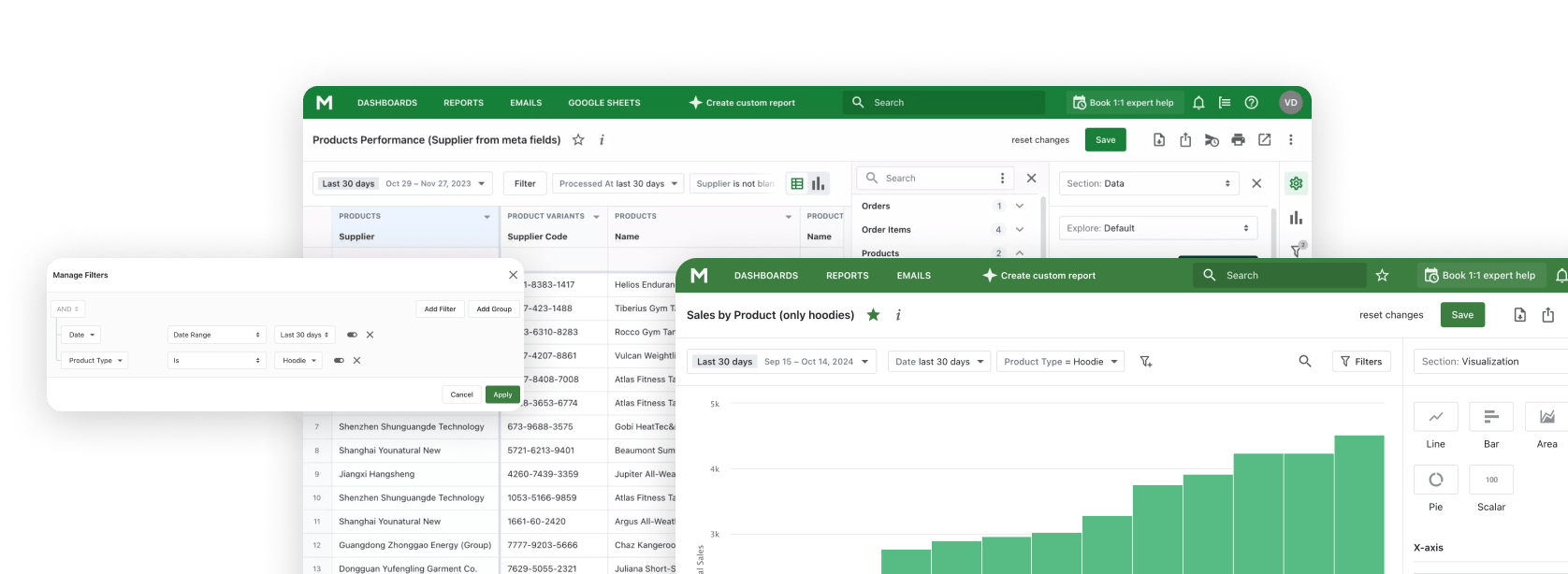

- Open Mipler in your Shopify admin.

- Find the "Tax per Counties" report in Mipler Report section.

- Select your date range (e.g., today, last 7 days, last month or year). You can also filter by state if needed – for example, show only Florida to get a Florida sales tax per county view.

- Run the report to see a sales tax per county breakdown – each county and its tax collected will be listed.

- Export the report: Download the report as a spreadsheet, PDF, or other format that you prefer to keep records or share with your accountant.

Automate Your Shopify Tax Per County Report to Optimize Your Store

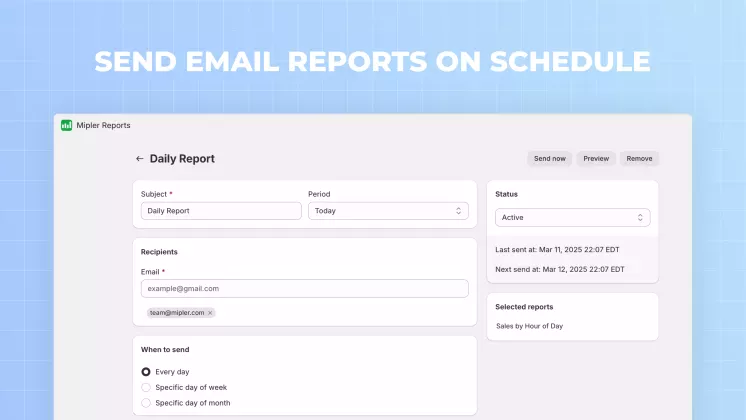

With Mipler, you can automate the Shopify sales tax report by county. In the app's schedule settings, set up a recurring email for the county tax report. For example, have the system email you a PDF of the Shopify sales tax report by county every month or quarter. This way, you'll always have the latest sales tax per county data without any manual work. Automating the Shopify sales tax report by county ensures you always stay on top of these numbers.

Important

Keep your Shopify tax settings up to date for each state and county – your Shopify sales tax report by county is only as accurate as your input. Mipler's Shopify Sales Reports also display taxes on each order. Monitor sales tax per county regularly to avoid surprises at tax time.

FAQ

Does Shopify have a built-in sales tax per county report?

The basic reporting system present in Shopify does not provide data segmentation based on county tax levels. These sales tax details at the county level are not provided to users. Most merchants use Mipler's app to generate their own sales tax per county reports, which function as Shopify sales tax reports by county.

How do I ensure the sales tax per county report data is correct?

The report relies on actual order data, but its accuracy depends on how well you set up Shopify tax settings. When you establish your tax rate configurations properly, the sales tax report by county that Shopify generates should match the actual tax income from each county. Every county sales tax amount in your report needs to match your shop's recorded tax revenue numbers.

Can I use the Shopify sales tax report by county for multiple states or countries?

Absolutely. The Shopify sales tax report by county demonstrates all sales activity that took place in any county throughout all states. The report summarizes sales tax data across every county in all regions for quick analysis. This tool combines all sales tax per county records from different regions within one report. It also allows businesses with multi-state or international sales to control and maintain tax compliance across every county with ease.

After using a Shopify sales tax report by county, do I still need to file taxes myself?

No – Mipler provides the numbers but doesn't file them. It gives you the sales tax per county totals to plug into your tax forms, but you still have to submit those forms yourself. Simply copy the county totals from the Shopify sales tax report by county into your tax forms. With a trusty report, the filing process goes quicker, and you can feel confident that you've included everything.