Taxes are the part of business in which it is very unpleasant to make a mistake. And even though Shopify doesn't file tax returns for store owners, it helps you control the process of calculating taxes, adjust interest rates, and store all this information in reports.

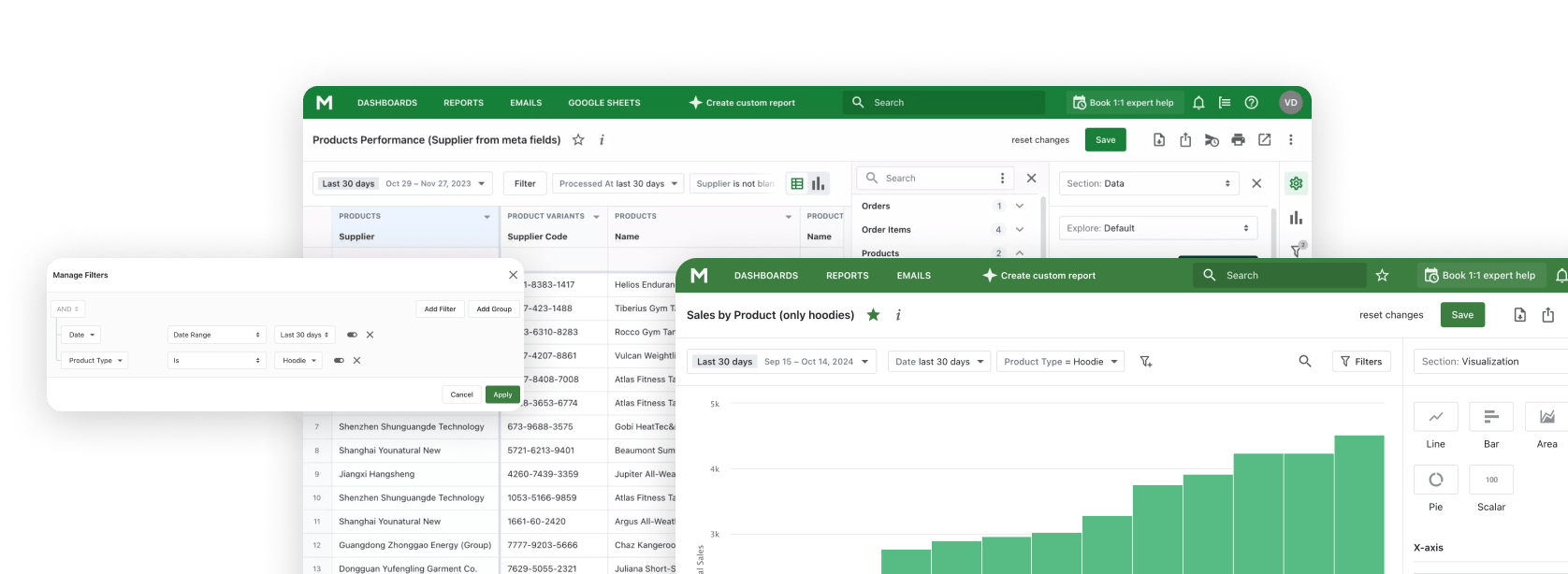

Mipler Reports simplifies the process by offering flexible, customized solutions for Shopify stores to solve sales tax problems. Check out other Shopify reports to learn more about the platform's capabilities.

Why Are Shopify Tax Reports Important

Shopify tax reports are the main documents that help to control the percentage of sales or profit paid to the state. Without them, it would be difficult to check and prove that all actions were legal and fair. In addition, they provide additional advantages when used for stores:

- Ensure compliance with tax legislation in all countries, not just the US: each country has its tax rate. If you correctly set up tax rates for different countries and states, Mipler reports for Shopify will automatically account for all the necessary taxes.

- Simplify the financial audit process: the reports are well-structured, providing detailed and reliable records, and the information is easy to customize with the help of filters and adding the necessary columns.

- Help analyze taxes for each product: one of the Shopify tax reports from Mipler helps you see what tax you must pay for each product unit.

How to make Shopify tax reporting more flexible

Tax systems of different countries differ, and Mipler allows you to tailor Shopify tax reporting to your specific needs:

- Customizable settings

Change tax rates and rules directly in Shopify to match local laws, and all changes will be automatically applied in Mipler for Shopify tax reports. - Segment reports based on criteria

Create reports based on product categories, regions, or periods required for correct documentation. - Dynamic date ranges

Set appropriate filters in each report so they will help you file taxes at the right time. - Flexible export options

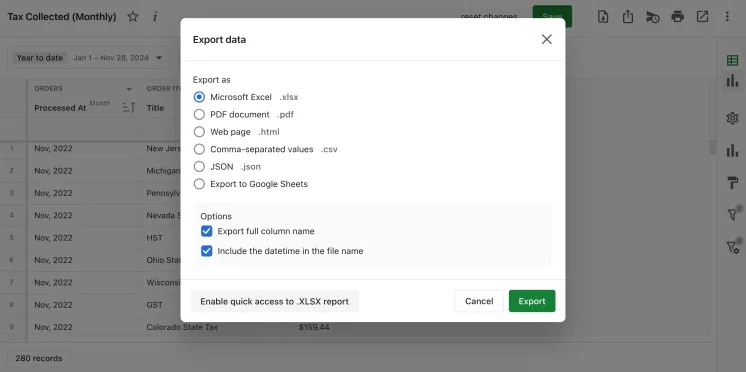

Export reports in XLSX, CSV, PDF, or Google Sheets to simplify tax filing and audits.

Create Shopify Sales Tax Reports with Mipler

Mipler offers Shopify store owners not only to read sales tax reports. Of course, there are other reports, which we will cover in the next section. However, it is worth paying attention to the fact that Mipler Shopify reports for taxes can not only simplify the management of taxes. In addition, you can get solutions to the following problems:

-

Problem: Different systems require different data formats.

Solution: You can export the data as Microsoft Excel (.xlsx), PDF document (.pdf), Web page (.html), or comma-separated values (.csv).

-

Problem: The team needs to share the report and be able to edit it.

Solution: All reports can be exported to Google Sheets and shared with team members.

-

Problem: The report has a lot of data, so it is difficult to see and make a single opinion about the dynamics immediately.

Solution: Each report has a dashboard for data visualization.

-

Problem: The team needs to view reports in the app and have access to dashboards.

Solution: Each report has a unique reference. You don't need to be authorized to access the data; you just need a link.

Important

Taxes follow sales: accurate Shopify sales tax report prevent underpayment, penalties and costly audits. Showing taxes per item helps reconcile collections, identify misconfigurations, and allocate liabilities by jurisdiction. Exportable, dated and versioned reports enable quick filing, transparent audits, and secure collaboration between merchant, accountant and auditor.

Shopify Tax Reports – what's available with Mipler

In addition to the standard Shopify sales tax report, Mipler has developed reports that will simplify the process of submitting tax returns.

Tax per Country

If you distribute your products in more than one country, you must pay taxes in all the places where your products are bought. The Tax per Country Report provides general information on how much tax a store has to pay in each country.

| OrdersCountry | OrdersNumber of orders | Order ItemsTotal Quantity | OrdersNet amount | Order Item TaxesTotal Tax Amount |

|---|---|---|---|---|

| United Kingdom | 51 | 213 | €4,577.58 | €0.00 |

| Belgium | 19 | 82 | €1,086.70 | €89.04 |

| Netherlands | 11 | 45 | €717.45 | €65.59 |

| Germany | 11 | 65 | €982.28 | €76.58 |

| Austria | 4 | 36 | €568.65 | €51.31 |

| Sweden | 1 | 4 | €89.46 | €4.07 |

| United States | 1 | 7 | €159.05 | €0.00 |

| Denmark | 1 | 9 | €191.91 | €9.94 |

| France | 1 | 2 | €41.48 | €1.81 |

| Italy | 1 | 9 | €174.92 | €11.43 |

| Poland | 1 | 2 | €63.98 | €2.71 |

| 102 | 474 | €8,653.46 | €312.48 |

Tax per State

This report is similar to the previous one. However, it shows taxes for each US state.

| OrdersCountry | OrdersProvince | OrdersNumber of orders | Order ItemsTotal Quantity | OrdersNet amount | Order Item TaxesTitle | Order Item TaxesTotal Tax Amount |

|---|---|---|---|---|---|---|

| United States | Alabama | 2 | 3 | $260.00 | AL STATE TAX | $0.00 |

| United States | Alaska | 1 | 4 | $131.75 | AK STATE TAX | $0.00 |

| United States | Arizona | 15 | 74 | $3,964.98 | AZ CITY TAX | $72.18 |

| United States | Arizona | 15 | 74 | $3,964.98 | AZ COUNTY TAX | $0.00 |

| United States | Arizona | 15 | 74 | $3,964.98 | AZ STATE TAX | $207.94 |

| United States | Arkansas | 4 | 15 | $711.23 | AR STATE TAX | $0.00 |

| United States | California | 13 | 40 | $2,375.58 | ALAMEDA COUNTY DISTRICT TAX SP | $73.12 |

| United States | California | 82 | 273 | $13,617.48 | CA CITY TAX | $94.41 |

| United States | California | 303 | 954 | $48,911.68 | CA COUNTY TAX | $116.10 |

| United States | California | 16 | 54 | $2,693.69 | CA SPECIAL TAX | $25.72 |

| United States | California | 303 | 954 | $48,911.68 | CA STATE TAX | $2,769.84 |

| United States | California | 6 | 15 | $654.81 | CONTRA COSTA COUNTY DISTRICT TAX SP | $9.49 |

| United States | California | 2 | 6 | $430.68 | FRESNO COUNTY DISTRICT TAX SP | $2.83 |

| United States | California | 2 | 4 | $0.00 | HUMBOLDT COUNTY DISTRICT TAX SP | $1.02 |

| United States | California | 1 | 3 | $98.37 | INYO COUNTY DISTRICT TAX SP | $0.53 |

| United States | California | 287 | 900 | $46,217.99 | LOS ANGELES CO LOCAL TAX SL | $435.94 |

| United States | California | 123 | 368 | $19,515.76 | LOS ANGELES COUNTY DISTRICT TAX SP | $407.62 |

| United States | California | 9 | 35 | $2,088.22 | MARIN COUNTY DISTRICT TAX SP | $14.18 |

| United States | California | 3 | 20 | $1,259.83 | MONTEREY COUNTY DISTRICT TAX SP | $5.76 |

| United States | California | 2 | 2 | $137.92 | NAPA COUNTY DISTRICT TAX SP | $1.06 |

| United States | California | 1 | 3 | $106.88 | NEVADA COUNTY DISTRICT TAX SP | $0.20 |

| United States | California | 21 | 55 | $2,581.68 | ORANGE COUNTY DISTRICT TAX SP | $13.01 |

| United States | California | 2 | 29 | $451.13 | RIVERSIDE COUNTY DISTRICT TAX SP | $2.06 |

| United States | California | 6 | 12 | $429.50 | SACRAMENTO COUNTY DISTRICT TAX SP | $2.04 |

| United States | California | 1 | 4 | $244.77 | SAN BERNARDINO COUNTY DISTRICT TAX SP | $0.52 |

| United States | California | 30 | 91 | $5,030.32 | SAN DIEGO COUNTY DISTRICT TAX SP | $23.04 |

| United States | California | 30 | 104 | $5,709.11 | SAN FRANCISCO COUNTY DISTRICT TAX SP | $68.95 |

| United States | California | 8 | 21 | $1,021.09 | SAN MATEO COUNTY DISTRICT TAX SP | $20.54 |

| United States | California | 5 | 18 | $700.14 | SANTA BARBARA COUNTY DISTRICT TAX SP | $2.22 |

| United States | California | 13 | 43 | $2,335.36 | SANTA CLARA COUNTY DISTRICT TAX SP | $46.04 |

| United States | California | 3 | 8 | $330.76 | SANTA CRUZ COUNTY DISTRICT TAX SP | $4.49 |

| ... | ... | ... | ... | ... | ... | ... |

| 1008 | 3156 | $165,009.88 | $9,058.23 |

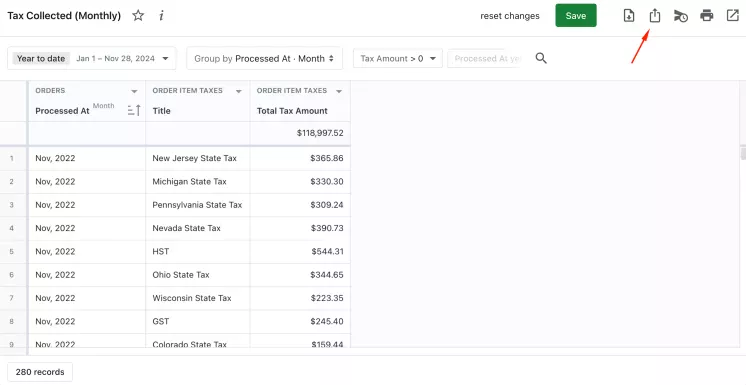

Tax Collected (Monthly)

The Collected Taxes report (monthly) is similar to Shopify's default tax report. It shows the taxes paid each month for the last year, which is very convenient for writing tax returns or auditing finances.

| OrdersProcessed At · Month | Order Item TaxesTitle | Order Item TaxesTotal Tax Amount |

|---|---|---|

| Jun, 2022 | Georgia State Tax | $15.96 |

| Jun, 2022 | Haralson County Tax | $4.50 |

| Jun, 2022 | Kentucky State Tax | $6.78 |

| Jun, 2022 | North Carolina State Tax | $4.28 |

| Jun, 2022 | Spalding County Tax | $2.70 |

| Jun, 2022 | Virginia State Tax | $2.62 |

| May, 2022 | Atkinson County Tax | $6.56 |

| May, 2022 | Bartow County Tax | $2.64 |

| May, 2022 | Brunswick County Tax | $2.56 |

| May, 2022 | Carroll County Tax | $7.41 |

| May, 2022 | Cherokee County Tax | $2.32 |

| May, 2022 | Dodge County Tax | $3.36 |

| May, 2022 | Effingham County Tax | $2.24 |

| May, 2022 | Forsyth County Tax | $3.39 |

| May, 2022 | Georgia State Tax | $80.27 |

| May, 2022 | Hancock County Tax | $2.56 |

| May, 2022 | Haralson County Tax | $8.73 |

| May, 2022 | Kentucky State Tax | $40.19 |

| May, 2022 | Lowndes County Tax | $2.40 |

| May, 2022 | North Carolina State Tax | $35.29 |

| May, 2022 | Rabun County Tax | $10.35 |

| May, 2022 | Virginia State Tax | $20.70 |

| May, 2022 | Ware County Tax | $2.24 |

| Apr, 2022 | Bartow County Tax | $3.84 |

| Apr, 2022 | Berrien County Tax | $2.96 |

| Apr, 2022 | Carroll County Tax | $11.78 |

| Apr, 2022 | Chatham County Tax | $2.81 |

| Apr, 2022 | Chesterfield County Tax | $2.26 |

| Apr, 2022 | Columbia County Tax | $2.40 |

| Apr, 2022 | Dodge County Tax | $3.52 |

| Apr, 2022 | Forsyth County Tax | $8.77 |

| ... | ... | ... |

| $798.16 |

Tax Details

In this report, each sold option is presented in a separate row. In this way, you can see absolutely all taxable sales. Use filters on the variant value or any other value in the data grid to reduce the number of data records displayed.

| OrdersName | OrdersProcessed At | Order ItemsSKU | Order ItemsProduct Name | Order ItemsVariant Name | Order ItemsTotal Quantity | Order ItemsTotal Price | Order Item TaxesTitle | Order Item TaxesTotal Tax Amount |

|---|---|---|---|---|---|---|---|---|

| #1602 | May 10, 2022 12:29 AM | LMXS | Stretch Short | LIME / XS | 1 | $48.00 | CA COUNTY TAX | $0.12 |

| #1602 | May 10, 2022 12:29 AM | LMXS | Stretch Short | LIME / XS | 1 | $48.00 | CA STATE TAX | $2.88 |

| #1602 | May 10, 2022 12:29 AM | LMXS | Stretch Short | LIME / XS | 1 | $48.00 | LOS ANGELES CO LOCAL TAX SL | $0.48 |

| #1602 | May 10, 2022 12:29 AM | LMXS | Stretch Short | LIME / XS | 1 | $48.00 | LOS ANGELES COUNTY DISTRICT TAX SP | $1.08 |

| #1602 | May 10, 2022 12:29 AM | GRNXS | Stretch Short | GREEN / XS | 1 | $48.00 | CA COUNTY TAX | $0.12 |

| #1602 | May 10, 2022 12:29 AM | GRNXS | Stretch Short | GREEN / XS | 1 | $48.00 | CA STATE TAX | $2.88 |

| #1602 | May 10, 2022 12:29 AM | GRNXS | Stretch Short | GREEN / XS | 1 | $48.00 | LOS ANGELES CO LOCAL TAX SL | $0.48 |

| #1602 | May 10, 2022 12:29 AM | GRNXS | Stretch Short | GREEN / XS | 1 | $48.00 | LOS ANGELES COUNTY DISTRICT TAX SP | $1.08 |

| #1120 | May 10, 2022 7:22 AM | RSS | Stretch Short | ROSE / S | 1 | $48.00 | AZ CITY TAX | $0.86 |

| #1120 | May 10, 2022 7:22 AM | RSS | Stretch Short | ROSE / S | 1 | $48.00 | AZ COUNTY TAX | $0.00 |

| #1120 | May 10, 2022 7:22 AM | RSS | Stretch Short | ROSE / S | 1 | $48.00 | AZ STATE TAX | $2.69 |

| #1120 | May 10, 2022 7:22 AM | BLS | Stretch Short | BLACK / S | 1 | $48.00 | AZ CITY TAX | $0.86 |

| #1120 | May 10, 2022 7:22 AM | BLS | Stretch Short | BLACK / S | 1 | $48.00 | AZ COUNTY TAX | $0.00 |

| #1120 | May 10, 2022 7:22 AM | BLS | Stretch Short | BLACK / S | 1 | $48.00 | AZ STATE TAX | $2.69 |

| #1126 | May 10, 2022 8:33 AM | BLKXS | Stretch Short | BLACK / XS | 1 | $48.00 | NY COUNTY TAX | $2.04 |

| #1126 | May 10, 2022 8:33 AM | BLKXS | Stretch Short | BLACK / XS | 1 | $48.00 | NY SPECIAL TAX | $0.18 |

| #1126 | May 10, 2022 8:33 AM | BLKXS | Stretch Short | BLACK / XS | 1 | $48.00 | NY STATE TAX | $0.00 |

| #1631 | May 12, 2022 09:10 AM | BLL | Stretch Short | BLUE / L | 1 | $48.00 | CA CITY TAX | $0.43 |

| #1631 | May 12, 2022 09:10 AM | BLL | Stretch Short | BLUE / L | 1 | $48.00 | CA COUNTY TAX | $0.11 |

| #1631 | May 12, 2022 09:10 AM | BLL | Stretch Short | BLUE / L | 1 | $48.00 | CA STATE TAX | $2.59 |

| #1631 | May 12, 2022 09:10 AM | BLL | Stretch Short | BLUE / L | 1 | $48.00 | LOS ANGELES CO LOCAL TAX SL | $0.43 |

| #1631 | May 12, 2022 09:10 AM | BLL | Stretch Short | BLUE / L | 1 | $48.00 | LOS ANGELES COUNTY DISTRICT TAX SP | $0.97 |

| #12344 | May 10, 2022 11:37 AM | LMS | Stretch Short | LIME / S | 1 | $48.00 | CA CITY TAX | $0.48 |

| #12344 | May 10, 2022 11:37 AM | LMS | Stretch Short | LIME / S | 1 | $48.00 | CA COUNTY TAX | $0.12 |

| #12344 | May 10, 2022 11:37 AM | LMS | Stretch Short | LIME / S | 1 | $48.00 | CA STATE TAX | $2.88 |

| #12344 | May 10, 2022 11:37 AM | LMS | Stretch Short | LIME / S | 1 | $48.00 | LOS ANGELES CO LOCAL TAX SL | $0.48 |

| #12344 | May 10, 2022 11:37 AM | LMS | Stretch Short | LIME / S | 1 | $48.00 | ORANGE COUNTY DISTRICT TAX SP | $0.24 |

| #1634 | May 10, 2022 11:53 AM | HYDM | Stretch Short | BLUE / M | 1 | $48.00 | OH COUNTY TAX | $0.84 |

| #1634 | May 10, 2022 11:53 AM | HYDM | Stretch Short | BLUE / M | 1 | $48.00 | OH STATE TAX | $2.35 |

| #1639 | May 10, 2022 12:25 PM | BLM | Stretch Short | BLACK / M | 1 | $48.00 | MI STATE TAX | $2.30 |

| #1642 | May 10, 2022 12:38 PM | BLM | Stretch Short | BLACK / M | 1 | $48.00 | MI STATE TAX | $2.88 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 30 | $1,440.00 | $81.82 |

Build and automate your Shopify Tax Reports and save your time

Process automation saves a lot of time. Mipler can offer you to schedule reports. Set up periodic reports to be sent to you and your colleagues. Then, you will receive automatic updates at regular intervals.

Any changes you make in the administrative part of your Shopify store are automatically reflected in the application. This feature is especially useful when the store sells products in different countries. Changes in interest rates are automatically taken into account when building reports.

Pre-built templates also facilitate the process of tax control. You can use ready-made templates to start quickly and customize all indicators as needed.

FAQ

What products are taxable?

Taxable products vary by jurisdiction but generally include physical goods, digital products, and services. Always check regional tax laws to ensure compliance.

How does Shopify handle sales tax?

Shopify uses a tax engine to calculate sales taxes automatically based on customer location and product type. It helps businesses comply with tax regulations in various regions.

Does Shopify Automatically Collect Sales Tax?

Unfortunately, no. The system can't collect sales taxes automatically because the process has different rules. As a store owner, you must decide on your own when it is appropriate to collect sales tax. However, Shopify does calculate sales tax for purchases if you set it in settings. You may also use the Shopify Tax's liability insights. It will show you the rules for tax collection for each US state.

How to get tax documents for Shopify store from Mipler app?

- Open "Tax Collected (Monthy)" report

- Click the "Export" button

- Choose the format in which you want to download and click "Export":