As the owner of an online store, you have probably asked the question more than once: how to increase profits in the future. But it is difficult to plan the future without knowing the past. The past for an online store is not only the history of sales, but also what it failed to sell for a certain period of time.

The very things that failed to sell are your inventory and ... your biggest asset. And this is not in a figurative sense. At the official level, the value of stocks in reporting is called current assets. Therefore, inventory is both the past and the future of your store. And inventory assessment helps to obtain reliable data for rethinking the inventory and management strategy.

In this article, we will answer the question: what is inventory valuation? What is revaluation of stocks for? How to implement it without complications? What is the benefit of this process and why does your store even need it? And some others.

Getting answers to these questions will be valuable to you as a store owner. They will help to analyze and understand:

- which products should be promoted?

- which do not bring the expected profit?

- how to dispose of stocks in the future?

In addition, taxation, profitability of your business, warehouse, pricing, and future risks are very closely related to your inventory management decisions. And the correct valuation of inventory is the key to their successful management.

What is inventory valuation?

Inventory valuation can be considered as a process and as a result. In the first case, this is a calculation of the cost of goods that have not been sold for a certain period of time, taking into account additional costs for acquiring or manufacturing the product, including transportation, handling, storage, insurance, and other costs

If you look at the inventory of valuables from the second point of view, then this is a specific amount - the value of your stocks. We received it after an assessment or audit of your warehouses. Usually, inventories of valuables are still perceived from the first point of view, so in the article we will consider them as a process.

Inventory valuation meaning

The definition is complex and confusing, so we'll break it down and explain. We consider inventory valuation as a process during which we calculate the value of all products remaining at the end of the reporting month/quarter/year. And not only the cost price of goods multiplied by their quantity is important, but also other costs incurred while these goods were stored in the warehouse.

So that the concept of valuation is not an abstract concept, we have listed what other costs are added:

- Direct labor payment for the work of workers who serviced stocks, for example, a sorter, a packer. In addition, taxes, insurance, pension payments are taken into account. BUT only what relates to the payment of labor for the maintenance of the warehouse or goods in the warehouse.

- Direct materials are materials used to store, package, or produce goods. In addition, the good news will be that defective, broken, discarded materials and waste are also taken into account. Direct materials can include boxes, wrapping paper, and storage shelves.

- Factory overhead costs. They arose in the process of processing and storing goods. In addition to rent, utilities, security, insurance, purchased tools, repair and replacement of posessions during this period are also taken into account. Moreover, the wages of those employees who serve warehouses are taken into account.

- Freight - the cost of delivering goods or raw materials to an enterprise or warehouse.

- Handling - expenses for preparation of products for shipment: box, packaging, materials for branding, payment for labor for packing goods, loading. Literally everything that prepares the finished product for shipment.

- Import duty is the duty you paid to get the goods to the warehouse.

Explore related reports

Purpose of inventory valuation

Every action has a purpose, why is this action happening. This is not a philosophical statement, especially when we are talking about business. There is also a reason why you should evaluate your inventory. Aspects affected by the evaluation result will allow a better understanding of the value of this process.

You'd be surprised how many areas of business depend on how you value your inventory. Let's look at each point:

- First of all, this is the cost of the product. It directly depends on how you will evaluate your stocks.

- It is logical that the price of goods varies depending on their cost price. Therefore, as a result, inventory valuation also affects pricing in your store.

- Reporting. Due to the fact that your current assets are displayed in the reports, the reporting also depends on the results of the assessment.

- And of course, if your reporting changes, so do the taxes you pay.

- In addition, the size of your assets is a way to evaluate the efficiency of the enterprise. Yes, of course, according to logic, stocks depend on efficiency, and not the other way around. But inventory estimates allow you to see how effectively the store, its inventory, and sales are managed.

- Loans. You are an experienced entrepreneur, so you understand that the one who gives the loan always looks at whether the business can pay it back. It is easiest to understand this by evaluating the company's inventory.

- And, of course, if creditors look at inventory valuation, investors will definitely look at it as well.

From what areas are affected by the results of calculations, it can be concluded that the goal, first of all, is to get a clear picture of the financial situation. This is a global goal, but it is this process that helps to clearly see whether the company has a financial cushion and potential for development.

What are inventory valuation methods?

If it were enough to evaluate the goods by multiplying the cost price of the goods by their quantity, then we would not raise this topic. There are several nuances that must be taken into account so that you get the right result:

- The cost of the products you purchase for storage changes over time. Inventory valuation is not performed with each purchase, but at the end of the reporting period. And changes in prices need to be taken into account so that the results are reliable.

- The cost of additional materials is also taken into account, which complicates calculations and requires special attention.

Price changes occur constantly, and in order to take them into account, different methods offer different approaches to inventory valuation.

There are many methods, but we will consider only four. They are the most understandable, the easiest to apply, and they cover the widest range of business needs. Most likely, one of them was already used, but did not know about it. Also, what kind of products you sell will help determine which methods are right for you and which aren't.

Top inventory valuation techniques

As we say previously there are four methods to evaluate your inventory:

- FIFO - First in first out

- LIFO - Last in first out

- WAC - Weighted average cost

- Specific identification

So let's discover how these methods work, and how the advantages and disadvantages will affect your store.

To make it clearer for you, let's take as an example an online store that sells skin care cosmetics. Using this example, we will consider and analyze all methods.

FIFO

The first-in, first-out (FIFO) method is probably the most popular method. It is intuitive, because those goods that were bought first and sold first - this is clear from the name of the method. In FIFO accounting, it is easy to track how much was spent on stockpiling goods and their maintenance.

If we consider this method in our example, then we imagine the following situation: you agreed to have hand cream delivered to you. On Monday, they brought you a box with the cost of each cream $5.00. On Tuesday, another box was brought to you with the cost of each cream $5.00. And on Wednesday, you also received another box, but the cost of each cream is already $5.20. And now you start selling the creams that arrived on the first day. In addition, you sell all creams at a cost of $5.00. And the balance that will remain in the warehouse, you will count at the cost of $5.20.

Advantages

- FIFO's greatest advantage is its simplicity, as it aligns costs with actual cash flow and the physical movement of goods in the warehouse.

- Any inventory carried over from the previous fiscal year does not affect the cost of goods sold (COGS).

- Manipulation can be avoided, because the method does not allow you to select goods for sale, and controls that the first ones that entered the warehouse were sold first.

- Additional costs are also taken into account in order, and therefore the costs incurred at the end of the place do not affect the income.

Disadvantages

- In economics, it's common for product prices to gradually increase over time, with occasional rapid spikes, especially for agricultural goods affected by extreme weather and climatic conditions.

- Inflation negatively affects the assessment results - they become inaccurate.

- The method makes it possible to increase the profit, but the tax also increases, because it is calculated from the income.

- The goods that remained in the warehouse are assigned a higher cost price. Because of this, there may be discrepancies between expenses and income in the Shopify reports.

LIFO

It is logical that the second method we will analyze is the opposite of the first. This method is called "last in, first out" (LIFO). In this method, we work with stocks in the reverse direction - the goods that were bought last are the first to be sold.

For convenience, we take the same example: within three days, a box of hand cream is delivered to you. The cost of each cream on the first and second day is $5.00, and on the third day the cost of each cream in the box is $5.20. And if you use the LIFO method, then you will be the first to sell the creams, brought on the third day and with a cost price of $5.20. And when evaluating the balances, you will use the cost of $5.00.

Advantages

- Undoubtedly, the first advantage of this method is to reduce the tax paid by the company, since the profit is less.

- Reduces income tax liability during inflationary periods.

- Minimizes inventory write-downs.

- Facilitates alignment of revenue with costs.

- It is very convenient to use when the costs of raw materials and labor become more expensive - it allows you to maximize profits.

>Disadvantages

- The biggest disadvantage is that some goods may not be sold due to moral obsolescence and non-relevance.

- If products sell slowly, over time it may happen that there will be no place to store new products.

- Using this method can bring a loss if unsold goods remain in the warehouse.

- The further it is, the more difficult it will be to service the goods due to an increase in their number.

- Accounting is more difficult than when using other methods.

- The final stock is not precisely estimated.

- This method is not common outside the United States.

- Not effective for stores that sell products with a short shelf life.

WAC

Consider also a method that gives average results, comparing LIFO and FIFO. It is easier to calculate than LIFO, because it is enough to take the total cost of goods purchased and divide it by the number of units that will be sold to get the cost of all goods. This is called the weighted average.

For calculations, let's take the previous example. Let's add a little more data: on Monday there were 20 tubes of cream in the box, on Tuesday - 35, on Wednesday - 25 - a total of 80 tubes of cream. This means that your calculations will be: COGS = ($5.00*20 + $5.00*35 + $5.20*25)/80 = $5.06. The goods that you sell, and stocks, will have such a cost price.

Advantages

- Service costs are calculated in the same way as the mobi value of goods. Therefore, if you cannot clearly track additional costs, this method will be ideal.

- Reserve estimation has an average value and is the most accurate among the previously described methods

- There is cost standardization for all stock lots

- Does not allow manipulation of results

- Allows you to see the most accurate picture of the material situation.

Disadvantages

- It does not always show the exact direction of movement of stocks

- There are few tax benefits when using this method

- Average profit value.

Specific identification

Unique items require a special inventory method. Therefore, this method is called specific identification. It is absolutely not similar to FIFO and LIFO, because it does not group products, but works with each one separately - its price and the cost of additional service are written on the product.

It is clear that this method is used for expensive, unique or rare goods. And the method of specific identification makes it possible to follow the movement of each product in the warehouse separately using serial numbers, date of receipt or RFID tags.

There is no need to give an example of calculation by this method. And so it is clear that if the antique clock cost $10,000, the cost of its maintenance is $1,000. The cost of this particular product on the scale is $11,000. The cost of all other objects is calculated in the same way. To get the total result, you just need to add all the received values.

Advantages

- Facilitates easy calculation of ending inventory.

- All calculations are done manually, so this is probably the most accurate method for determining inventory valuation.

- Clearly contrasts real expenses and received income.

Disadvantages

- Due to the high value of goods, there may be unfair manipulations with their value and income.

- A lot of effort and time must be spent on detailed manual calculations.

How is inventory valued?

FIFO

This is how the formula for calculating the cost of inventory according to the FIFO method looks like:

Cost of oldest inventory * amount of inventory sold

Let's consider how the calculation will look in practice, using our previous example about a store of care cosmetics. Let's say you estimate inventory for Q1. You have an initial supply of $500 worth of hand cream. You made the following purchases between January and March:

| Month | Cost per unit | Quantity |

| January | $5.00 | 20 |

| February | $5.00 | 35 |

| June | $5.20 | 25 |

A total of 80 tubes of hand cream were purchased at a total cost of $405. At the end of the quarter, your Shopify Sales Report shows that 25 jars of cream were sold in the first quarter.

Since you originally bought the cups for $5.00, your COGS calculation would be $5.00 x 25 = $125.

So, using FIFO, your ending inventory estimate would be: Beginning Inventory ($500) + New Purchases ($405) - Cost ($125) = $780.

LIFO

Using the LIFO method involves using the following formula:

Cost of recent inventory * amount of inventory sold

Using the same example as above, let's imagine that you use LIFO to determine the cost of inventory. The cost of the hand cream has increased over 3 months, as can be seen in the Unit Cost column.

You would calculate the COGS at $5.20 per mug because these creams were sold most recently. The result is COGS = $5.20 * 25 = $130.

The calculation of stock valuation is as follows: Beginning Inventory ($500) + New Purchases ($405) - COGS ($130) = $775.

WAC

To calculate the cost of inventory under the WAC method, you should use the following formula:

Cost of goods available for sale / total number of units in inventory

When describing the WAC method itself, it was written in detail how the cost is calculated when using this method. That's why we can use these calculations now: the cost of each unit will be $5.06, so the cost of all goods sold will be equal $5.06 * 25 = $126.5

As a result, the inventory value will be as follows: Beginning Inventory ($500) + New Purchases ($405) - COGS ($126.5) = $778.5.

Before proceeding to the description of the specific identification method, let's compare the results obtained after calculating the cost of stocks according to the previous methods:

- FIFO - $780

- LIFO - $775

- WAC - $778.5

As we can see, the theory was confirmed by practice.

Specific identification

This method is used for each product separately. Therefore, a separate cost price is calculated for each product. Let's say that in February you had $11,000 worth of goods at the beginning of the month. During the month, you bought 3 paintings for $5,000 each, for a total of $15,000. At the end of the month, you calculated that the maintenance costs for these paintings were $6 000, and two of them were sold.

It is clear that the cost of each painting is $5,000. Therefore, the cost of inventory will be calculated as follows: Beginning Inventory ($1,100) + New Purchases ($15,000) - COGS ($10,000) - associated costs ($6,000) = $10,000

Why is the valuation of inventories important in financial reporting?

After we have considered how different inventory valuation methods affect pricing and inventory management, it is worth analyzing how they affect financial reporting. In this case, there is one difference - the choice of method will be influenced by the location of your business. More precisely, it is important in which country you report.

According to the International Financial Reporting Standards (IFRS), it is forbidden to use LIFO methods for inventory valuation. However, US law is more flexible in this regard, so under US Generally Accepted Accounting Principles (GAAP) you will be able to use LIFO for inventory valuation. Accordingly, if you are reporting outside the US, it is most convenient to use the FIFO or WAC methods.

Basically, the values of some indicators will change in the reporting. It depends on the method you choose, because they affect the amount of gross profit, the amount of working capital and the amount of tax you want to receive. Depending on what is more important to you, you will choose the inventory valuation method. Here's how methods affect them:

- FIFO provides a high gross profit, but at the same time higher tax payments compared to other methods.

- LIFO gives the lowest gross profit of the other methods, also, using LIFO, you will pay the lowest taxes compared to other methods.

- When using WAC, you will get averaged values of all indicators.

- The financial condition is best seen when using specific identification, because we get the most accurate assessment results. But at the same time, it is easy to manipulate net income with its help.

How to choose the right method of inventory stock valuation among others?

There are no exact criteria or rules that would unequivocally indicate which method is best for you. Each of them has its advantages and disadvantages, and you, as a store owner, need to decide which advantages can overcome the existing disadvantages, taking into account your individual situation.

We can only more precisely form this list of "pros" and "againsts" of each method and suggest which criteria should be paid more attention to. If we analyze all four methods together, it is worth saying that:

- Each method produces a different gross income: FIFO is the highest, WAC is the average, and LIFO is the lowest. But at the same time, when using FIFO, you will pay more taxes than with all other methods.

- The obvious simplicity of calculations makes FIFO the most popular method, but with high inflation the results can be inaccurate. And LIFO combines recent income with recent expenses, which avoids the effects of inflation.

- LIFO very often does not reflect the exact picture of inventory movements, while FIFO, on the contrary, allows you to see it accurately.

When choosing a method, you especially need to pay attention to the following features:

- The products you sell. The first role in choosing a method is played by the expiration date of the products. If it is limited, then LIFO and special identification is definitely not your option.

- The country in which you file and pay taxes. For example, the LIFO method is authorized for use under the U.S. Generally Accepted Accounting Principles (GAAP), but prohibited by International Financial Reporting Standards (IFRS). That is, you can use LIFO only on the territory of the United States.

- Inventory maintenance costs. This point is indicated for a reason, because the result takes into account not only the goods themselves, but also how much it cost to maintain them. In the case when additional costs grow, LIFO will help increase the cost of the inventory itself, and therefore it is more profitable to use this method in this situation. And FIFO is more appropriate to use in the opposite case - when inventory costs fall.

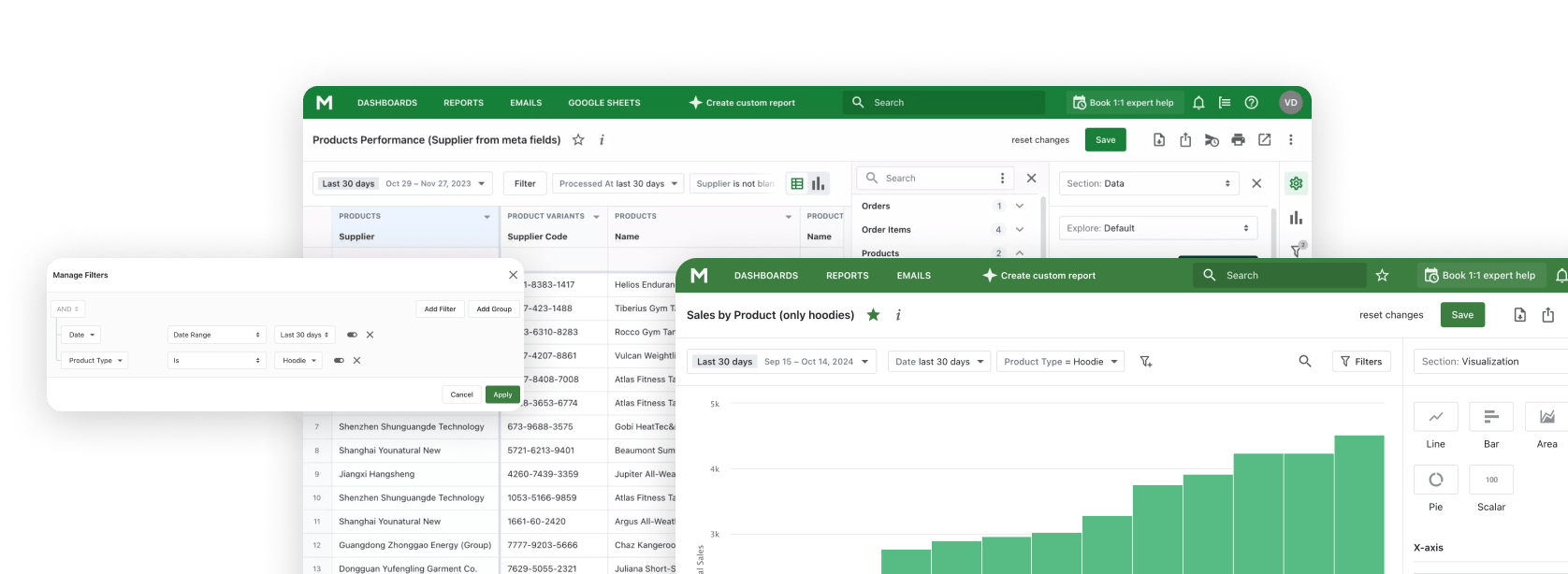

How can Mipler help?

When evaluating your reserves, Mipler makes it its main task to provide reliable data. The Shopify Inventory on Hand Report is convenient because it displays the current inventory picture, as well as all the items for the month you need. Using this data, you can easily make the necessary calculations.

Conclusion

Well, we're glad you've read this long and informative article to the end. As you can see, stock assessment is a time-consuming task, but existing methods help make the process easier. Of course, you need to choose based on which problems need to be solved first, because you have seen that each method helps in one situation and harms in another.